Month of satisfaction and disappointment (say Housers)

That’s it, month of satisfaction (Crowdestor and Robo.cash) and disappointments (Housers and Mintos), because December has been less profitable than October and November, mainly because Housers has ignored its payment obligations and has contributed nothing to the 636€ generated this month by the rest of the platforms.

Below you can see the profitability of each one in detail:

Mintos has been a disappointment for another month, but I have paid back 39 euros and I am below the 1000 euros invested. At this rate I will forget about Mintos in two years. I now have only 6.5% invested (60 euros), as the rest (920 euros) is still in the process of recovery.

Peerberry remains constant, maintaining a high number of available projects which last month reached the milestone of EUR 22.3 million funded.

Another 9 Euros were given to me by Viainvest in December, which continues to consolidate as a safe and smooth bet.

This month, Robo.cash was the main attraction, contributing 286 euros in interest thanks to the investment campaign in projects in Singapore, which gave me 226 euros.

As usual in Crowdestor, they have had a month with lights and shadows. The lights: the Mafia Stars project has made an advance of 21% on the capital to be delivered on 6 January and the Saapio project has been brought up to date with payments.

The shadows: five projects are more than 90 days overdue, although we have a commitment to pay for one of them (Forestland Investments) from January, another without news since early November (Inch2) despite the publication by Crowdestor and, as a novelty, I have acquired in the secondary market the project Wholesale Food Trade with an amount of 34€ to try.

In spite of this, this month they have contributed 320 euros very welcome. Furthermore, they have launched a vote to accept or not the proposal of the promoter of the Consumer Loan Portfolio Acquisition project, which seemed to be a joke.

Regarding Wisefund, they have surprised the market by launching a new projectwhen we all anticipated the probable end of the platform. Last attempts? It should be remembered that they are unprincipled people who have not informed their investors for months and do not provide a solution to their short-term defaults.

In Lenndy I have stopped the autoinvest since December 29th because they hardly launch any projects and I have 35 out of 38 projects delayed.In addition, new investors will not be able to registeruntil mid-January, so I have deleted the bonus link to avoid any inconvenience. December has contributed only 4 euros, when previously it was no less than 10 euros a month.

This month I sold my scarce Swaper portfolio, as they could hardly publish any projects. It has been an 11-month test that has not convinced me and I will not return to them until they increase their available projects.

On the other hand, for almost a year now I have been following Iuvo and Lendermarket, in which I have started to invest at the end of December with small amounts to see their evolution and test them. Below and in the Crowdlending section I leave you more details.

Bondster has given me €13 in December, which I hope will continue to work in the same way: high profitability, immediate returns and strict application of the Buyback.

This month, the developer of the Baltic Forest project, whose first meeting of creditorswas held on December 21, has been declared bankrupt. Crowdestate has informed that a bankruptcy committee has been appointed, which will have to analyse the situation and make claims on behalf of the debtors.

Grupeer published their latest news on the blog at the beginning of November, which I don’t know if it’s good news, and Bulkestate continues at their pace, slowly but surely, working quite well, even though they have only published two projects this month that have celebrated their 4th anniversary.

As a disappointment, Housers has not ceased to surprise us with a new lack of payment, in which they have failed to comply with the agreementwe reached three months ago on the Albufera III and Torres de Paterna projects and of which they only paid for the first month.

They did the same in the previous agreement, signed more than a year ago, so they are fooling investors again. How long will the CNMV (National Securities Market Commission), allow Housers to do this?

The President of the Association of People Affected by Housers has published a table with ALL the delayed projects and they are MANY. You will be amazed… Here you can see it in detail.

Finally, on Envestio there have been some new developments, while Kuetzal and Monethera have hardly changed from last month. You can see them all below.

And here are the details of each platform:

Mintos (extended version)

Although my results leave much to be desired, they still have countless followers, as it is still the number one P2P platform, with 92.5 million euros invested.

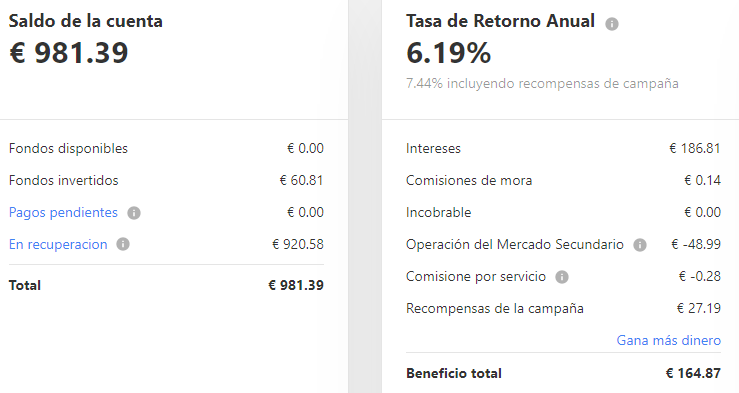

December has not been an exception and Mintos means disappointment, although I have returned 39 Euros and I only have 981 Euros on the platform’s balance sheet, which is 6.5% invested (60 Euros) and 920 Euros in the process of recovery.

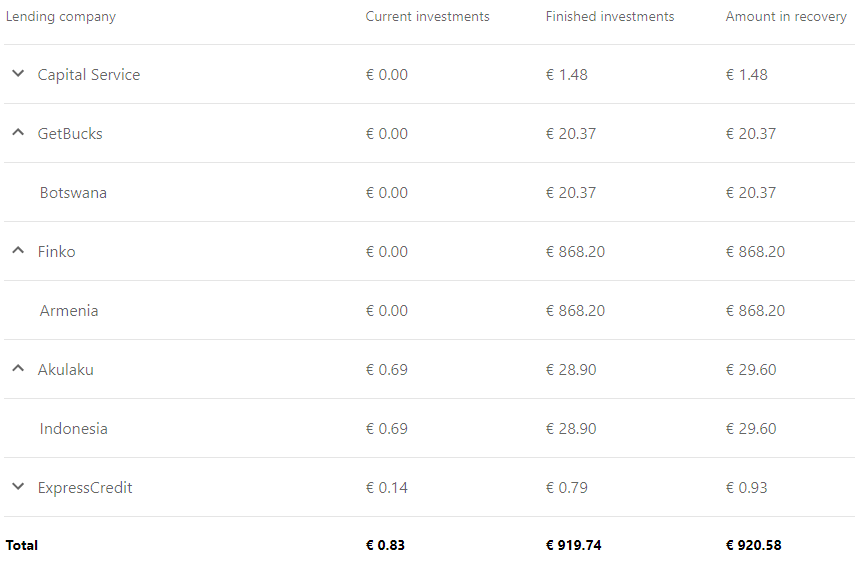

With regard to the outstanding payments, I am enclosing a screenshot of my current situation:

It seems that Finko Armenia, where I have the bulk of my investments in recovery, could pay back all the amounts until December 2022. So far this month I haven’t received anything back.

I still reproach Mintos for the fact that, until the moment when the platforms I invested in failed, they had been ratedbetween A- and B.

For the fifth year, Mintos has won the People’s Choice Award and, new this month, they have introduced the suitability and appropriateness assessment so that every new investor knows where to invest. I hope it is better than their 3 portfolio strategies: diversified, conservative and high yield, which I do not recommend.

If you really want to invest in Mintos, go to this website to verify that you are investing in originators with a score above 65, as it makes an independent assessment of each one.

My profitability continues to fall month by month and stands at a dismal 6.19%:

At the moment, I have stopped autoinvest since March 27th and continue to refund the amounts that continue to return me.

Peerberry (extended version)

On the verge of financing 400 million euros from November 2017, it continues to be stable and maintain numerous projects available, which last month reached its record figure of 22.3 million euros financed.

In December they exceeded 4 million euros in interest paid, a safe bet that provides a more contained return, without fallow or delays in returns. Here you have the sample:

Every few months I make withdrawals from my wallets to check their status and this month I did so with 52 Euros of Peerberry which arrived in two working days. In a couple of weeks I will increase my portfolio with them to 600-1000 euros.

Like Mintos, it is in the process of becoming an investment company, which will provide greater transparency and security. They plan to do so in spring 2021.

Great platform with minimal delays and all less than 15 days, as you can see in this current capture:

Viainvest (extended version)

December has brought some news to this platform. Among them, the minimum amount per withdrawal will be 10€ from January 10th and VIA SMS Group has published its financial statement for the first half of the year.

This platform continues to behave well, with hardly any delays, and the interest generated is quickly reversed. As with Peerberry, I have made a test withdrawal of 70 Euros from Viainvest that has reached my bank account in two days.

I am still satisfied with the security of Viainvest and the 9 Euros obtained in December continue consolidating this platform as a smooth bet.

Their plan is still to obtain a broker’s licence to comply with the new European regulations in 2021.

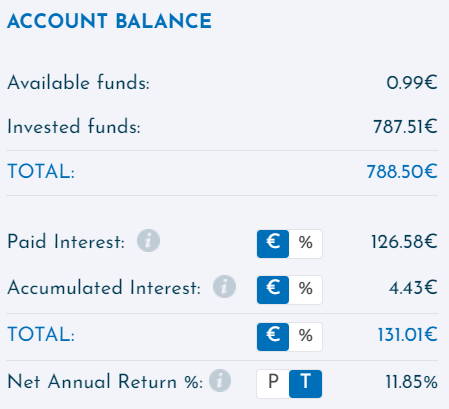

In December I reduced my portfolio to 42 short-term loans, of which 3 are in arrears. They are essential to achieve financial freedomand a current profitability of 11.85%.

With over 4.2 million funded this month, it remains a very reliable platform that rarely suffers any delays.

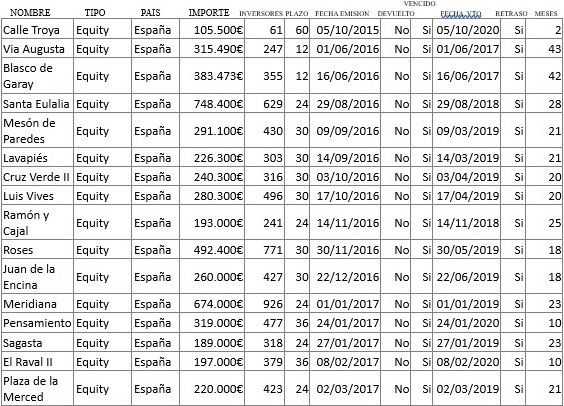

Robo.cash (extended version)

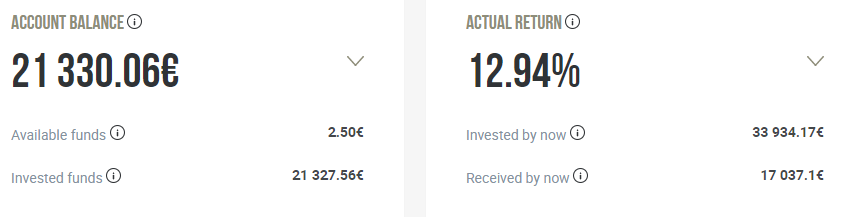

It has given me great satisfaction this month and is that I have obtained 226 Euros in interestfrom the investment campaign in Singapore, in addition to another 60 Euros between bonus and regular interest.

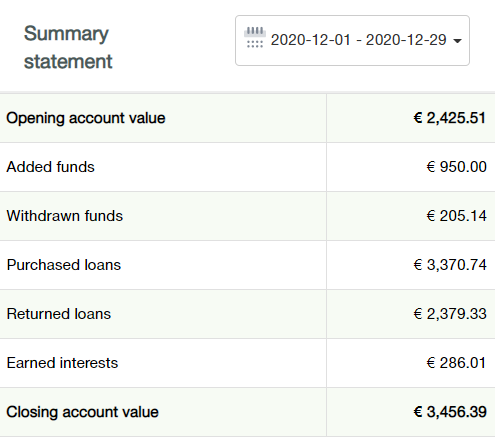

This month I expanded my portfolio by 950 euros to take advantage of the +1% profitability campaign in force until December 10, so my numbers are going to improve even further.

I also made a refund of 205 euros to check the health of the platform and it keeps confirming to me that it is in my TOP 3. Here is the summary of these movements:

Robo.cash has published an article presenting the excellent results of the first nine months of the year and as a great novelty, they have approved the entry of investment companies up to a maximum of 180,000 euros per year.

Currently I am at 12.69% return that you can see below, with delays of 1,016 euros on a total of 3,456 euros invested, but I must defend that their Buyback works like clockwork and 30 days later they pay interest on time:

And this is the monthly profitability chart. If you want more details, you can click on the “extended version” of each platform:

Crowdestor (extended version)

This month has had some satisfactions and others I expected and have come in the form of disappointments. Starting from the positive side, the Mafia Stars project has made a 21% advance on the capital to be delivered on January 6th, the Saapio project has caught up with payments thanks to a new parallel project and I have collected 320 euros in interest.

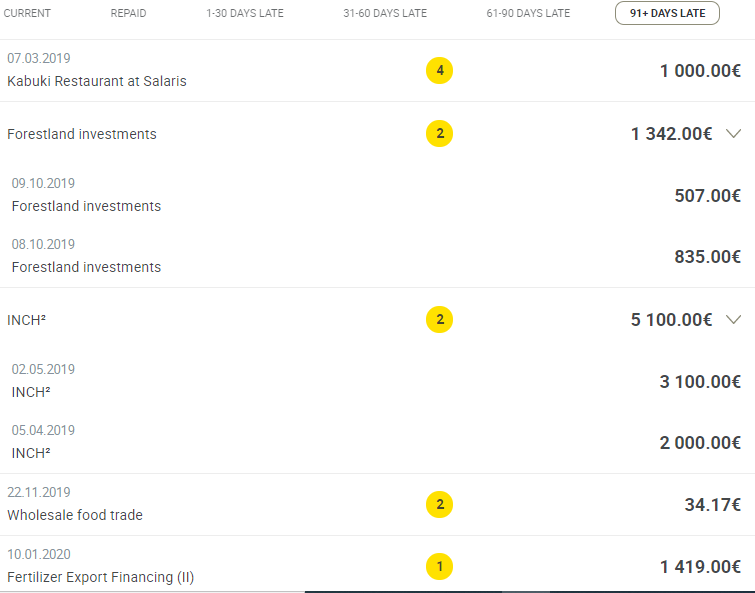

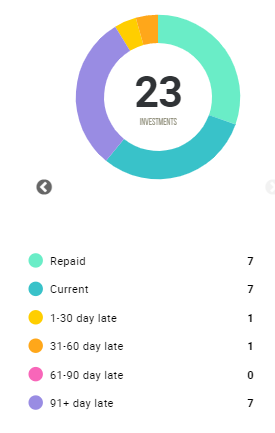

On the downside, their five projects are more than 90 days late:

- Forestland Investments appears to begin its payments in early January.

- Inch2 is still in limbo, as Crowdestor has not published any news since they promised to launch a new project in November.

- Kabukiis going through a delicate moment and it will be possible to vote the payment proposal in 4 years and provide 25% of the property to the investors.

- Wholesale Food Trade is a project in which I have acquired 34 Euros on the secondary market for testing and which should pay back its capital before the end of January.

- From the Fertilizer Export Financing project the only news I can advance is that I doubt we will be able to collect before next summer.

On the other hand, the promoter of the Consumer Loan Portfolio Acquisitionproject has launched a proposal for payment in two years reducing the return to 8%, which does not seem serious and I suppose it will be rejected in a vote.

In addition, this month has brought as news the launch of a new tax report and a donation campaign to help children with severe disabilities in which Crowdestor will contribute 10% of the total.

They have also published the webinar broadcast live on 10 December which you can see in detail here., which discussed the impact of the Covid-19 on the industry, the platform’s statistics and expectations for next year, as well as the launch of its autoinvest and payment platform, the obtaining of the new broker’s license and its opening to 5 new countries.

Finally, this month they introduced their new Operations Manager Anatolijs Putnja, whom we consider necessary and to whom we wish the best.

And here’s a screenshot of my current situation:

As of December 31, I have 16 active projects, which are actually thirteen as three of them are double investments:

They currently have seven projects to invest, each more attractive. But I have to follow my plan to lower my exposure in Crowdestor and increase my portfolio in Robo.cash, Peerberry, Viainvest, etc.

Lenndy (extended version)

This month I have not seen much activity in Lenndy and they have had days of fallow since 23 December, so I have stopped the autoinvest since 29 December.

On the other hand,I have 35 out of 38 projects in arrears, so I will withdraw some money from this platform and put it back in Robo.cash although I don’t worry too much because they always comply and pay the interest on arrears after 60 days.

In addition, they report that no new investors can registeruntil mid-January, so I have deleted the bonus for new users.

December has contributed only 4 euros, when previously it was no less than 10 euros a month.

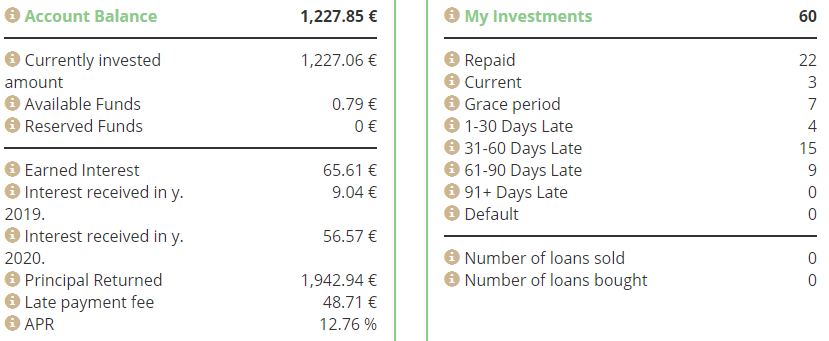

This is my situation as of December 29th:

The current 1,227 euros invested are wide among 38 active projects, which rent an average of 12.76% per year.

Bulkestate (extended version)

This platform continues to work perfectly, although they have only published two projects in December, which they should remedy, because their loyal legion of followers, with their autoinvest, are taking over all the available offer.

As an example, on December 29th they launched the Alberta Street project and within a few hours it had been funded, so they are again without projects available.

This month they have completed four years of successful career and can be proud of their work.

In March I invested the remaining 300 euros in the Amalijas Street project, with an LTV of 49% and a return of 12% per year. It’s time to wait until March 2021 to receive the 36€ interest.

Wisefund – possible scam (extended version)

Everyone affected by Wisefund is surprised by the launch of a new project called Mobile Ads Operations when we all anticipate the likely end of the platform:

I would like to remind those 42 unsuspecting investors that this platform is unpresentable and that there are many of us who have been suffering from their lack of communication and their non-payment for many months without any solution.

After much insistence I was informed that action is being taken to recover the unpaid amounts from the Dutch Flowers project through the company Cis Debt Recovery Solutions, but they do not know any details.

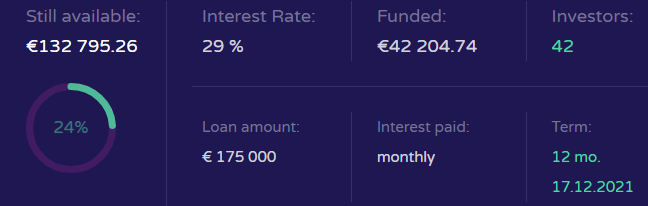

As of 30 December, interest for March, July, August, September and October remains unpaid, amounting to 118 euros, and has not been paid when the project expired on 13 October.

On 25 June they reported on the state of the project in which I have invested 1000€ named “Operating Cash for Dutch Flower Exporter” and despite the delay of three months due to the pandemic, they would meet the payment schedule. You can see they haven’t complied. Since July 31, they have not made updates to the project.

There is already a class action lawsuit against the platform among all potential affected, initiated by the law firm Magnusson that already works in the cases of Envestio, Kuetzal and Monethera. At the moment, the most up-to-date information can be found here.

The possibility of joining the reporting group is not open, but you can join the waiting list.

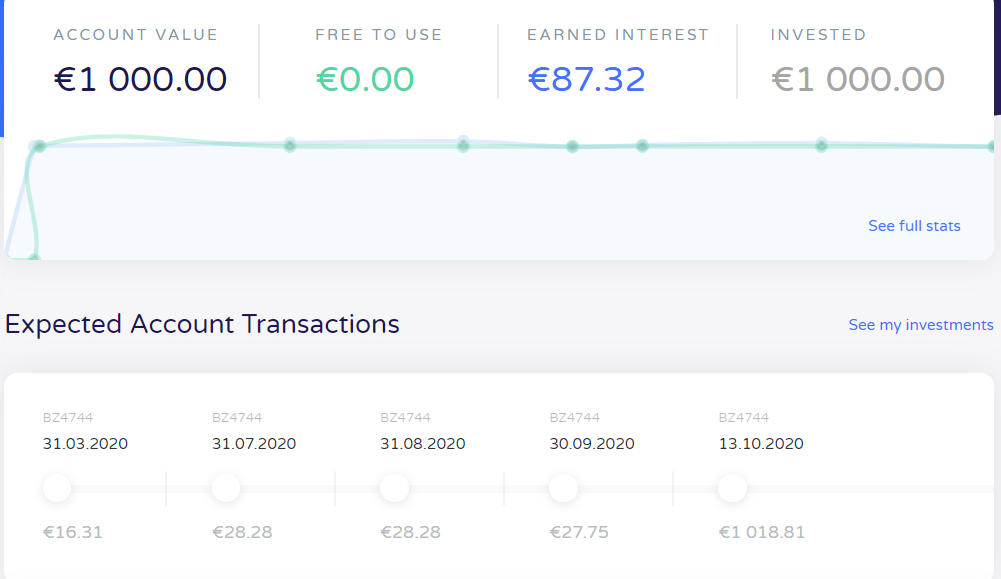

Swaper (extended version)

This month I sold my scarce portfolio, as they could hardly publish any projects, even though they say they publish hundreds of them every day.

It has been an 11-month test that has not convinced me and I will not return to them until they increase their available projects. He’s been disappearing from my portfolio since January.

Currently, this is my dashboard:

Bondster (extended version)

13€ return in December, while it is true that I have not invested in Lime MX which offers 17.5% per annum, most of my projects are between 16.5% and 17%, so I am currently at 16.79% per annum on average:

Of the 112 active projects, half suffer some delay, but this is not a concern, as it has a very efficient Buyback.

Crowdestate (extended version)

This month they have launched 6 new projects, but I continue with the policy of not investing in them until they solve the problem with the Baltic Forest project in which I invested 2,600 euros almost two years ago when its duration was 12 months.

The novelty this month is that the developer of the project, whose first creditors’ meetingwas held on 21 December, has filed for bankruptcy.

The information transferred from Crowdestate is that the bankruptcy committee has been formed to study the situation and will later present its conclusions, without a definite date.

To summarize, they are looking for a company-wide buyer urgently. Crowdestate transmits a certain tranquillity, ensuring that they have the necessary guarantees. The problem is that, according to Crowdestate’s initial forecasts, there are still 72 months to collect.

Lendermarket (versión ampliada)

This month I have deposited 300 euros on this platform that I have been studying for almost a year. I will see its evolution over time and inform you of any news.

For the moment, I send you the current screenshot:

Here you can see the pros and cons that I find in this platform, but basically it has been because it is in Ireland, it is associated to the huge Credistar Group and the originator is obliged to participate with a minimum percentage of 20% in each project.

Iuvo (versión ampliada)

Last platform on which I have invested 200 euros and will test for the next six months.

Here are the reasons for and against what I have found on this platform. In short, it was created in 2016 and has had no impact since then. There are 12 originators from various countries with a wide variety of projects and they must also contribute a minimum of 20% to each project.

Here’s your screenshot as of 30/12:

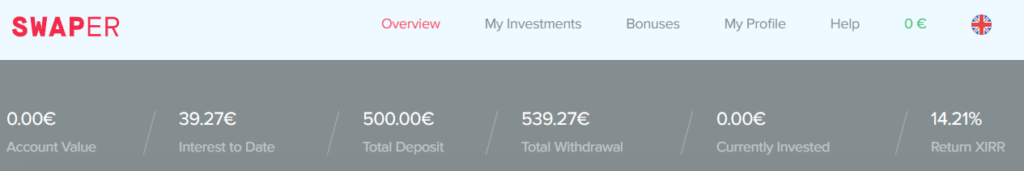

Housers (extended version)

Once again they have failed to meet their payment commitment made three months ago on the Albufera III and Torres de Paterna projects and in which they only paid for the first month. They’ve already accumulated two delays. They did the same in the agreement signed in 2019,so they trick investors again.

Of course, they have not paid for any of the other seven projects either, so this month I have charged ZERO euros in interest despite keeping almost 107,000 euros with them.

The President of the Housers’ Association has published a table with ALL the delayed projects and they are MANY. You will be amazed… Here you can see it in detail, but let me tell you that there are already 106 delayed projects with an outstanding amount of 40.8 million euros. Here’s a small sample:

I have the majority of projects without approving last year’s annual accounts which were to be held between October and November: Vara del Rey, El Raval II, Sagasta, Juan de la Encina, etc.

If you want to know more about all the Housers projects I’ve invested in, be sure to visit the Crowdlending tab or click here.

Given their bad practices and in view of the desperation of many investors, an association was set up to deal with them in court, together with a specialised law firm: https://www.afectadoshousers.com/

This platform of affected persons is very active and a few days ago dozens of documents were presented before the Audiencia Nacional accrediting the lack of contractual compliance by Housers. And in the meantime the CNMV (National Securities Market Commission) watching from the stands.

Needless to say, I haven’t recommended investing in this platform in years.

Grupeer– possible scam (extended version)

This month they have not deigned to write a single line about their situation. Will they already be enjoying our money in the Caribbean?

In November, they added on their blog that they are still taking steps to recover their operations and their bank account, while the company Recollecta is responsible for managing the collection of 10 million owed.

They also announced that they wanted to continue the company, but without information I don’t think they have a sincere interest.

The project in which I have invested 1113 euros ended in mid-May, but the originator is one of the whistleblowers, so I doubt I will get encouraging news from them in the coming months.

Monethera – confirmed scam (extended version)

While waiting for the status of the last bank accounts used by Monethera to find out about the whole financial picture, it seems that one of them was cancelled at the beginning of February for internal reasons and the bank seems willing to collaborate to follow the money of the plot.

Envestio – confirmed scam (extended version)

Progress has been made in reference to bankruptcy and is trying to figure out who was behind each bank transaction.

There are many other new developments this month, but they are kept secret and cannot be alerted to fraudsters. I hope they can be published shortly.

Kuetzal – confirmed scam (extended version)

We are trying to bring a corporation of companies to justice and open lawsuits against other debtors.

As with Envestio, for which Kuetzal shares some entities, managers and bogus companies, I cannot give more details so as not to give away the work that is being done, but great progress is being made.

RECOMMENDED PLATFORMS THAT OFFER WELCOME BONUS:

MINTOS: 0.5% of your investment from 500 euros during the first 30 days

PEERBERRY: 0.5% of your investment during the first 30 days

VIAINVEST: 15€ bonus with a minimum investment of 50€

CROWDESTOR: 1% of your investment during the first 90 days

ROBO.CASH: 1% of your investment during the first 30 days

BONDSTER: 1% of your investment during the first 90 days

LENDERMARKET: 1% de tu inversión durante los primeros 30 días