Updating my portfolio: January 2021

Yes, a month of little joy. January is usually a very irregular month and this year has been no exception.

Despite this, I sign another 367 euros of profitability from just over 27,000 euros invested in some European platforms, because the only Spaniard – Housers – has defaulted on its payment commitments for the third consecutive month.

This month I decided to report Housers and promoter Construbecker to the Courts of Madrid, so I had to advance to the law firm an amount that I have been able to meet between the emergency fund and the withdrawal on several platforms.

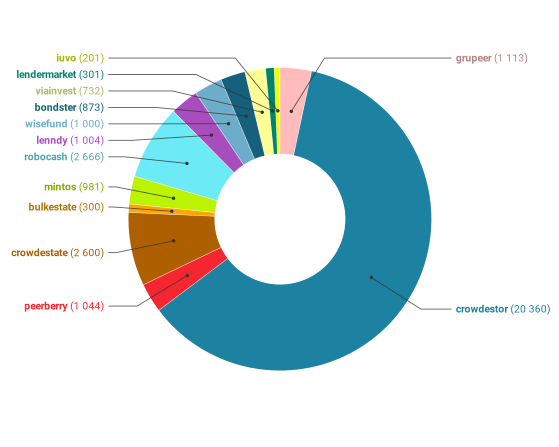

Here are the details of the current state of investments:

Mintos gave me back 2 euros this month of the 981 euros in the process of recovery and I only have 1€ invested. They have updated their Risk Scores, which you can see below.

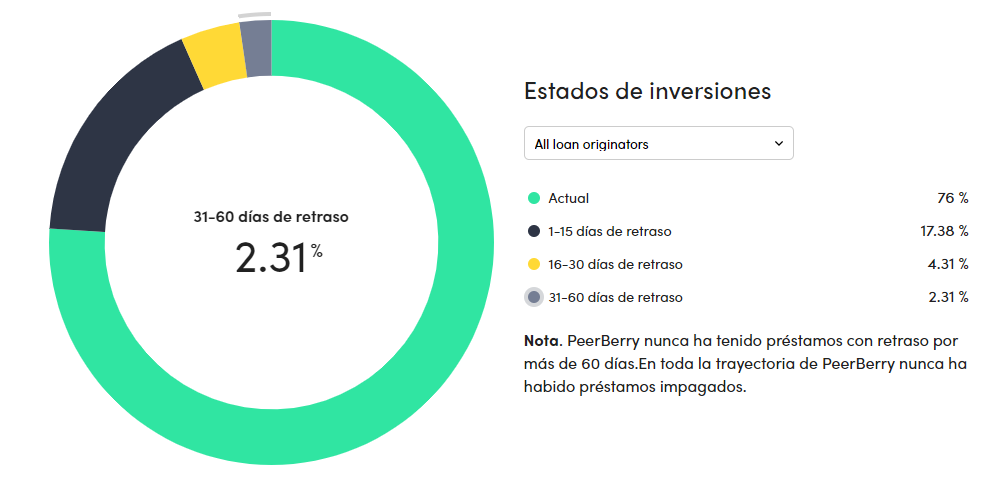

At Peerberry I have increased my portfolio because they continue to give me enormous confidence. In 2020 they increased their portfolio by almost 46% compared to the previous year and remain unpaid since its inception in 2017.

Viainvest is suffering from the lack of publication of projects, but continues to evolve with firm pace and has been able to generate 8 euros this month.

I continue to be very happy with Robo.cash and this month has rented 103 euros for the December promotional campaign and several project returns in Singapore.

Crowdestor has half-fulfilled this month. Despite having paid 231euros in interest, there are project management that continues to be delayed: Wholesale Food Trade (payment commitment at the end of 2020), Mafia Stars (delay in its full payment of capital), Kabuki (waiting for a vote from the first week of January), among others.

Wisefund launched in December a new project – Mobile Ads Operations – which today has reached 48% funding, but in January it has launched another one that has already been funded –App Acquiring Venture -.

Investors are still behaving badly. I remain unanswered to an email sent on January 25 regarding the lack of news since last July of the Dutch Flower Exporter project:

In Lenndy I stopped the autoinvest on December 29 because they hardly launch projects and the ones I have are all behind. My intention is to keep removing everything invested until I stop hearing noise from this platform.

For the time being, the First Finance operator remains suspended. Let’s hope they meet their commitments on the projects already funded, because I have almost half of them. The good thing is that everyone has a vehicle as collateral.

In addition, from 1 February they will have a secondary market in which projects of this operator can be sold.

IUVO and Lendermarket have reached one month and the result is being adequate, without great joy or disappointment. Both already have some delays, so I’ll be able to check the operation of their Buyback. I’ll tell you more details below.

At Bondster I have obtained 9 euros this month and it is still the platform that offers the most profitability, however I will reduce my portfolio.

Reasons? Since January 1, its CEO has left management and since March 1 its conditions will change, in which users will not be notified of new changes in their contractual terms. None of them I like.

In addition, with the money I withdraw from Bondster I will start investing in two new platforms that I am studying in detail: Estateguru and Evoestate.

In relation to Crowdestate nothing has changed:they still do not pay interest, return capital or update their latest news published in December, announcing that a bankruptcy committee had been assigned for the Baltic Forest project that would already inform us on some date not defined.

Grupeer seems to have disappeared from the map since early November and from the Telegram group it’s all assumptions.

On the other hand, Bulkestate continues to comply and in January they have published three projects with lower profitability that are financed in a few hours thanks to their stalwart.

Once again, Housers has disappointed its thousands of investors/affected in a month in which they have not paid a single euro. Therefore, a few days ago I filed a complaint against them and the promoter for the 70,000 euros that I have invested in two projects, although I know that a total of ten have been reported.

More and more of you affected by this platform have contacted me from all over Europe, mainly Italy, Portugal and Spain, where the projects are located. This month we have had some news that I share with you below.

In reference to Envestio, Kuetzal and Monethera it seems that good news arrives, some of which I explain later.

Mintos (extended version)

My results are still lousy, but they still have nearly 375,000 investors from 62 countries. It is the number one platform of P2P,with more than 6 billion euros invested.

They have published on Youtube a session with the situation of the suspended originators, in which they do not undertake to implement the Buybacks.

At the moment, I have withdrawn the welcome bonus from my blog,as I do not trust Mintos and its recovery policy. At the moment I do not recommend investing with them.

January has brought as its novelty the update of its Risk Box, which you can see here. Keep in mind that it is based on the movements of its 33 originators from July to September.

In an interview with its CEO Martins Sulte, it prioritizes the management of the 94 million euros in recovery as a priority for 2021.

I continue to reproach Mintos that, until the moment the platforms I invested in failed, had ratings between A- and B.

If you really want to invest in Mintos, log on to this website to verify that you are investing in originators with scores above 65.

Finally, the Bosnian originator Moneda has left the Mintos market.

My profitability continues to fall month by month and stands at a lousy 6%:

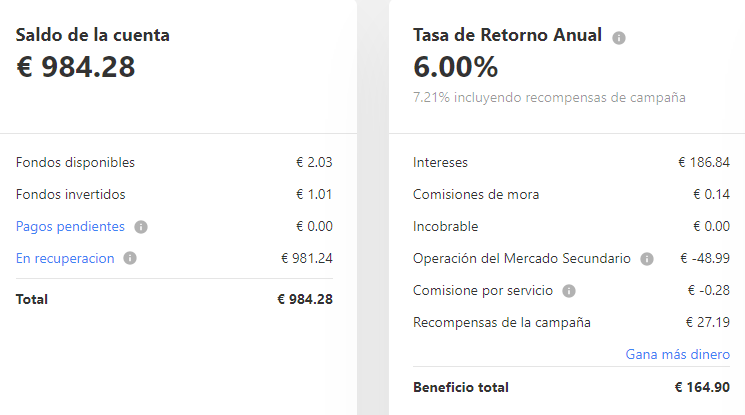

Peerberry (extended version)

With the recent information that Peerberry has delivered almost 2.5 million euros in interest during 2020, I find it even more surprising that they managed to increase the number of investors in the middle of the pandemic by 74%. Good for them!

It continues to behave in a stable way, which is why I have increased my portfolio with them almost 700 euros.

In addition, they maintain excellent communication with investors, thanks to which we have known that the new IBF license will cover 90% of them up to a maximum of 20,000 euros. They plan to obtain it by summer 2021, as do Mintos.

If you need to know where the company is headed and the publication date of its annual accounts, among other issues, check out this interview.

In December they have exceeded 4 million euros of interest paid, they are a safe bet that provides a more contained return, without fallow or delays in returns. Here you have the sample:

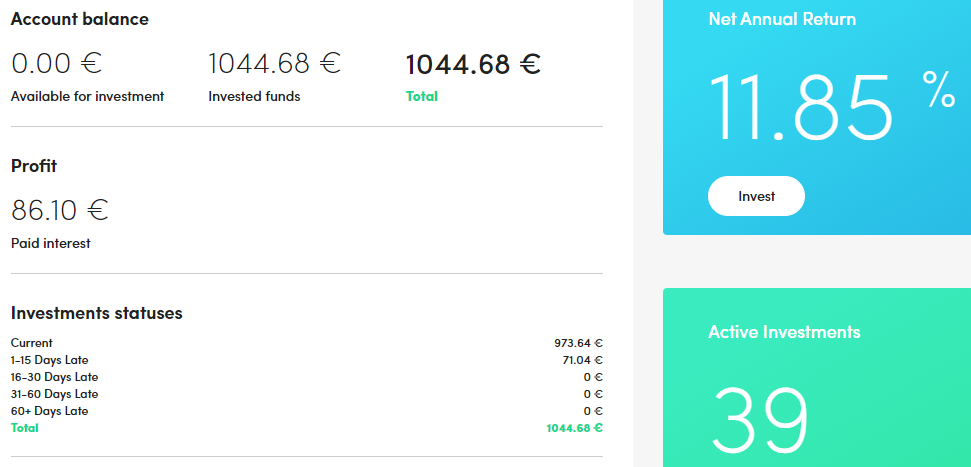

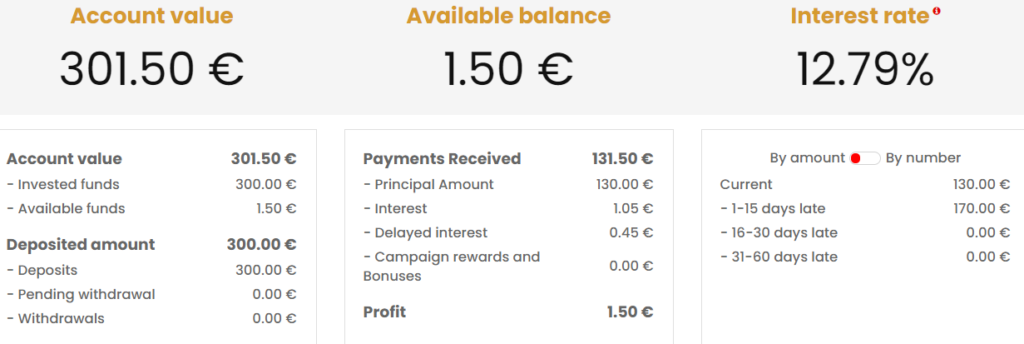

I expose my control panel as shown, with minimal delays and all less than 15 days:

Viainvest (extended version)

January has been a month in which Viainvest has suffered due to the lack of available projects.

Despite this, this platform continues to behave well, with hardly any delays.

I remain satisfied with the safety of Viainvest and the 8€ obtained in January continue to consolidate this platform as a no-doubt bet, although we will have to be attentive to the fallows.

It was one of the platforms from which I retired cash in January to pay for the law firm that will tender against Housers.

Like Mintos and Peerberry, their plan remains to obtain a IBF license to comply with the new European regulations in 2021.

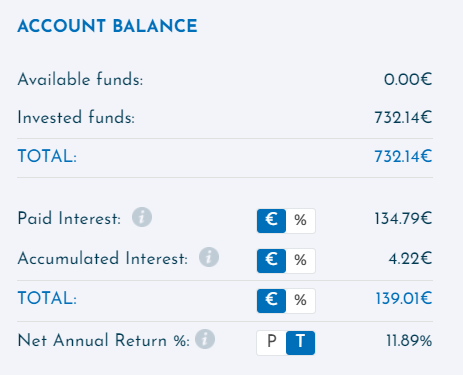

In January I have a portfolio of 37 loans, of which only 4 suffer delays. They are essential to achieve financial freedom and a current return of 11.89%:

Robo.cash (extended version)

I’m so happy with this platform! This month has brought me back the greatest joy in giving me back 103 euros of interest.

But because they are so agile and their Buyback is only 30 days, I always come to them when I need urgent money. And this month I’ve withdrawn 790€ in an 8-day matter, so as soon as I get a chance, I’ll re-enter them.

Robo.cash continues to surprise me, having surpassed its own record with 9.9 million euros financed in December.

In a recent interview with its Chief Financial Officer – Gregorii Shikunov – we learned that 88% of the funding comes from Holding Robocash and only the remaining 12% is financed through the platform. This provides extra security to consider.

Philippine projects do not appear at the moment because the platform believes that it poses a high risk to investors at the moment, so it has cancelled them.

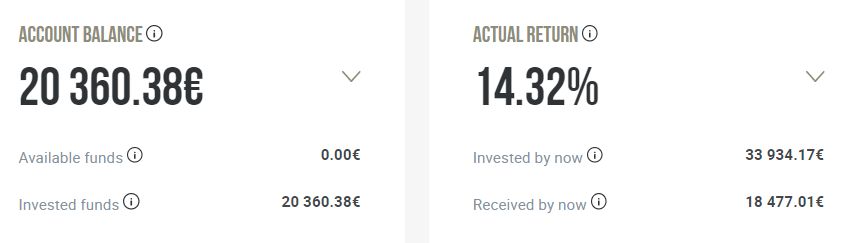

Currently I am at 12.47% profitability that you can see below, with delays of 1,043 euros over a total of 2,664 euros invested, but I have to defend that their Buyback functions as a clock and 30 days later pay the interest on time:

Crowdestor (extended version)

They have fulfilled some of their commitments, but others are experiencing some delays and are failing in their communications.

As an example, they announced at the end of November that the Wholesale Food Trade project would be paid in full in a month, which has not happened. Nor has a new campaign been launched for Inch2,promised in November.

Other projects are also experiencing delays that are not understood: despite good comments received from the Mafia Stars project, which ended on January 6, they are paying it in parts every two weeks and in amounts not previously agreed or announced.

Also the Kabuki project, which should have been voted on at the beginning of January and of which we have had no news.

Finally, from the Fertilizer Export Financing project we have known that legal action has been taken to recover our investment.

In my opinion, they have to improve their communication if they want to maintain their market share.

On the positive side,the 231 euros generated are always welcome and there are projects that are meeting their payment schedule on time. In addition, this month I have gone from 7 projects behind more than 90 days to only 5.

On the other hand, I am concerned that they are not just funding the projects, which had not happened before. Here is an example dated January 31, which was also very attractive and short-term:

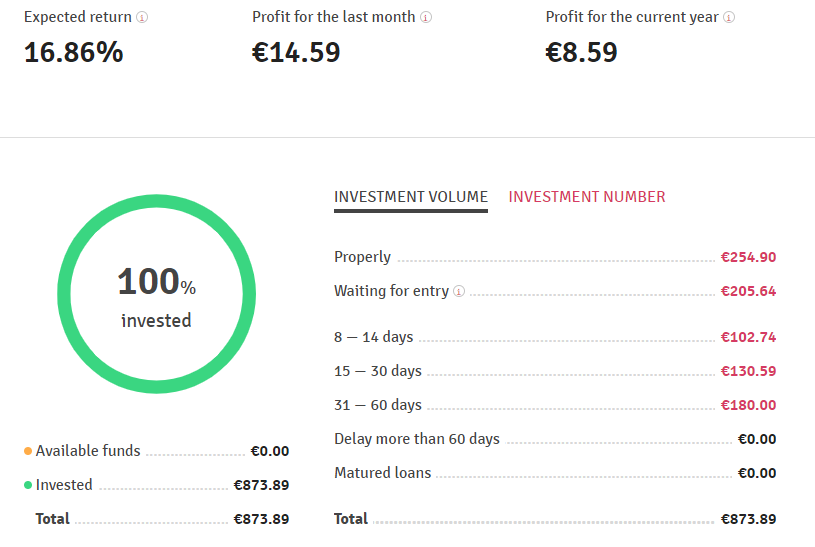

And here’s a screenshot of my current situation:

They currently have eight projects to invest, with a return between 19.5 – 36%. But I have to follow my plan to lower my exposure at Crowdestor and further diversify my portfolio.

Lenndy (extended version)

This month there has not been a great activity in Lenndy and have continued to have quite a few fallow days that have been suffering since December, so I keep stopped the self-invest.

On the other hand and even more importantly, I have all the projects delayed.

Lenndy has received a first draft audit from First Finance,which is still suspended and has begun reviewing its loan portfolio and cash flow analysis. That’s 7.2 million euros of which 5.3 million have Buyback.

In addition to opening a secondary market from February 1st to exit those projects of this trader, Lenndy is committed to keeping investors informed weekly.

My position is to withdraw everything invested in this platform until the situation is resolved. By logic, I’ve removed the bonus for new users.

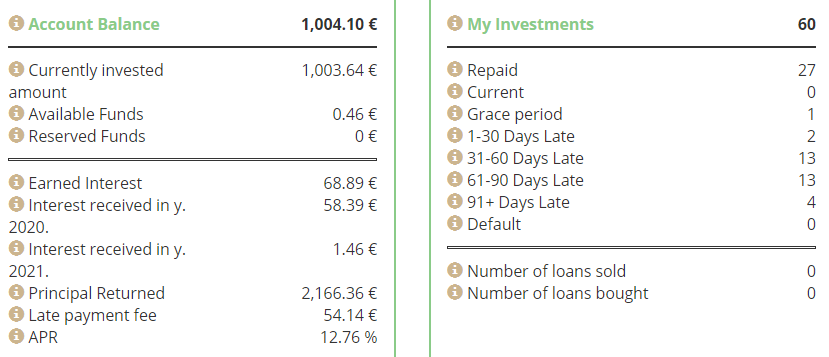

This is my situation as of January 31st:

Bulkestate (extended version)

Until March, I won’t receive my 36€ interest on the project I invested in a year ago. It’s very long because they barely publish projects with monthly payments, but the biggest problem I see is that they publish few projects. It’s been three in January.

But they continue to work perfectly, with no negative comment and their faithful legion of followers top the limited offer available with their self-research.

Now that I’ve studied their natural competence well – Evoestate and Estateguru – I’d like to diversify between the three, albeit with nuances that I’ll already publish when I invest in them.

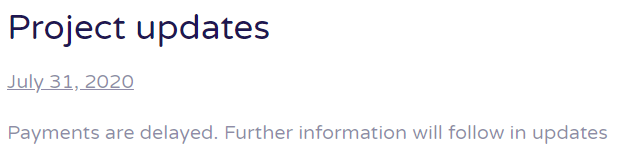

Wisefund – possible scam (extended version)

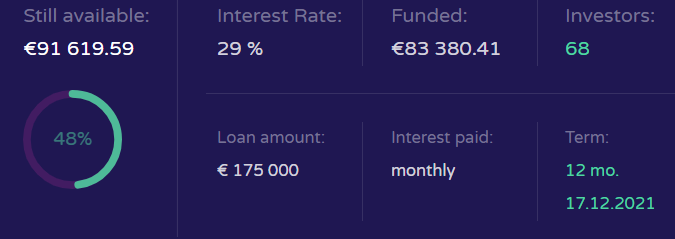

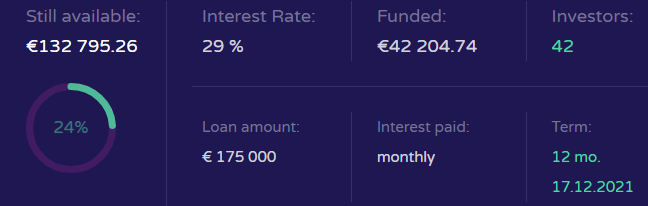

The thousands affected by Wisefund are surprised by the launch of a new project called Mobile Ads Operations and not so much that it was only funded 48% a month later:

But what has us completely off the board is that the App Acquiring Venture project has been funded in less than 20 days for only 29 investors, who have paid an average of 4,131 euros. Does anyone believe it?

I understand that it is a “ghost” project or some clueless has been fooled and has contributed a huge amount in this project. Time will tell.

In another order of affairs, I still have no response to an email sent on January 25 in relation to the lack of news since last July of the Dutch Flower Exporter project and that is that the communication of this platform with investors is non-existent.

I do not know if any collection management is being done through the company Cis Debt Recovery Solutions. If anyone can inform me, I would appreciate it. At the moment, I haven’t been able to talkto Wisefund owner Ingus Linkevics.

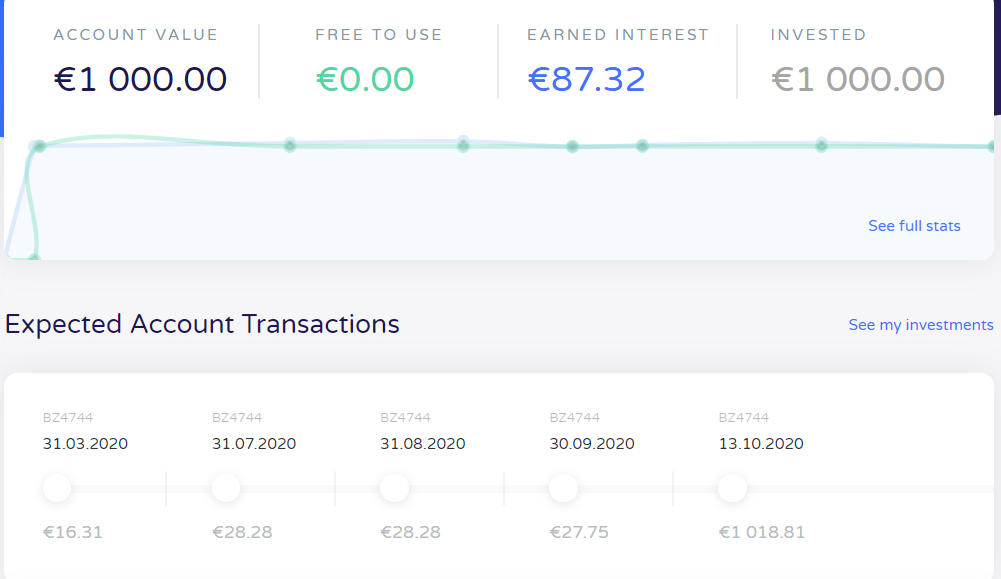

As of January 31, they still do not report or pay the interest on March, July, August, September or October, which amount to 118 euros and have not paid the maturity of the project on October 13th:

There is already a class action lawsuit against the platform among all potential affected, initiated by the law firm Magnusson that already works in the cases of Envestio, Kuetzal and Monethera. At the moment, the most up-to-date information can be found here.

The possibility of joining the reporting group is not open, but you can join the waiting list.

Bondster (extended version)

Today it is the most profitable platform, but I will reduce my portfolio because its CEO has left management and I do not agree with the new conditions that will come into force since March 1.

As a novelty, this month they have the new originator TengeDa from Kazakhstan.

Here’s my current situation:

Crowdestate (extended version)

In January they have launched 6 new projects, but I still do not invest in them because they do not return capital or interest, in addition to not updating their latest news published in December, which announced that a bankruptcy committee had been assigned for the Baltic Forest project.

Until they solve the problem with this project in which I invested 2,600 euros two years ago, when its duration was 12 months, they will not see me invest or recommend this platform.

It appears that they are looking for a buyer for the whole company urgently and although Crowdestate ensures that they have the necessary guarantees, according to their forecasts there are still 72 months to collect.

Lendermarket (extended version)

In December Ideposited 300 euros on this platform that I had been studying for almost a year. I will see its evolution over time and inform you of any news.

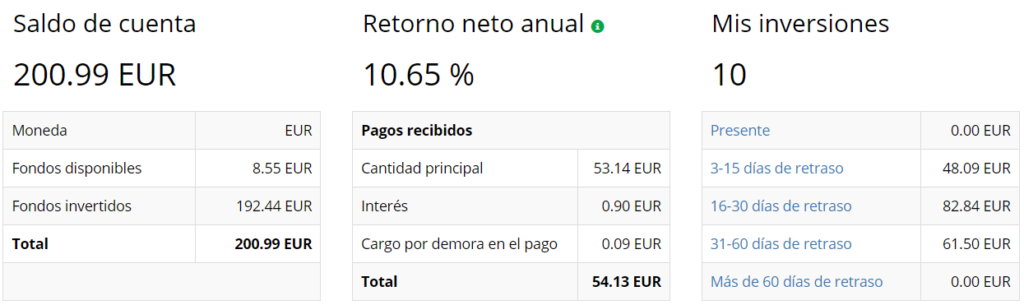

At the moment, I send you the current screenshot, with more than half of the investments with delays:

Here you can see the pros and cons that I find on this platform, but basically it was because it is located in Ireland, it is associated with the huge Credistar Group and the originator is obliged to participate with a minimum percentage of 20% in each project.

Iuvo (extended version)

Last platform on which I have invested 200 euros in December and will test it for the next six months.

Here are the reasons for and against what I have found on this platform. In short, it was created in 2016 and have had no incidents since then, have 12 originators from different countries with a wide variety of projects and must also contribute a minimum of 20% in each project.

This is my screenshot as of January 30th. You see that there are already many projects delayed, but on this platform I diversified among all the typologies to test their Buyback:

Housers (extended version)

What can I say about Housers that you haven’t heard before? Once again it has disappointed its thousands of investors/affected in a month in which they have not paid a single euro.

This is why, after asking for legal advice for months through various channels, I have decided to file a complaint against them and the promoter Construbecker for the 70,000 euros that I have invested in two of their projects.

These are the ten projects so querella has been filed by scam against both: Avenida del Puerto; Cardinal Benlloch; Albufera I, II, III; Torres Paterna I and II; Eliana; Tarragona and Llanes, which total 6,315,000 euros.

If any of my readers want to sign up for this complaint, you can still sign up for the lawsuit already filed. If you have any questions about how to proceed, you can contact me via email info@libertad-financiera.eu

There are also two very active Telegram groups to know all the news: https://t.me/housers_foro and https://t.me/housersCom

Increasingly, you have contacted me from all over Europe, mainly Italy, Portugal and Spain.

Once again they have breached their payment commitment reached in September in Albufera III and Torres de Paterna and in which they paid only the first month. There are already three delays, as in the agreement signed in 2019, so we are again deceived a second time.

Of course, neither have any of the remaining seven projects paid, so this month I have re-charged ZERO euros in interest despite keeping almost 107,000 euros with them.

Last Friday 29 January I was sent several ordinary calls to approve (or not) the 2019 annual accounts and extraordinary meeting to change the manager and continue to raise money at our expense while investors do not see a single euro.

If you want to know more about all the Housers projects I’ve invested in, don’t stop clickinghere.

Given their bad practices and the desperation of many investors, an Association was created to deal with them in court, together with the law firm that has filed my lawsuit.

This month there have been several articles about Housers. This has been published by Jean Galea and in this other we are informed that Housers has won the trial against his former partner Tono Brusola and that they will seek capital from new shareholders/investors/absent-minded.

Grupeer – possible scam (extended version)

They seem to have disappeared from the map since early November and from the Telegram group they are all assumptions. Will they already be enjoying our money in the Caribbean?

In November they added in their blog that they continue to make arrangements to recover their operations and bank account, while the company Recollecta is responsible for the management of the collection of 10 million owed.

The project in which I have invested 1113 euros ended in mid-May, but the originator is one of the whistleblowers, so I doubt to get encouraging news from you shortly.

Monethera – confirmed scam (extended version)

It appears that one of the financial institutions has given the judicial administrator incomplete accounts that could demonstrate its lack of transparency in reference to anti-bleaching legislation (AML).

This information would complete the map of features collaborating with Monethera and you could know the entire financial fabric.

Envestio – confirmed scam (extended version)

It seems that the case is gaining notoriety and is that it has appeared in a well-known Estonian medium. You can read an excerpt here.

The main thing is that more than 2,000 investors have presented battle and paid a deposit of 200,000 euros to continue the judicial process.

In Latvia, lawsuits have been filed against numerous intermediary companies and property and vehicles have been blocked.

Evidence collection procedures have been initiated in Estonia and the Court has authorized the communications to be unlocked to find out who is behind each transaction.

Kuetzal – confirmed scam (extended version)

It is trying to bring to justice a corporation of companies, among which there is an important and well-known one that is deriving its responsibility to a Russian client.

The network also moves to Hong Kong from Latvia, so there is still much work to be done to achieve results that make us think that we will get our money back.

As with Envestio, of which Kuetzal shares some entities, managers and fake companies, I cannot provide any further details so as not to give away the work that is being carried out, but great advances are being made.

RECOMMENDED PLATFORMS (neither Housers, nor Mintos, nor Crowdestate, nor Bondster) THAT OFFER WELCOME BONUS:

PEERBERRY: 0.5% of your investment during the first 30 days

VIAINVEST: 15€ bonus with a minimum investment of 50€

CROWDESTOR: 1% of your investment during the first 90 days

ROBO.CASH: 1% of your investment during the first 30 days

LENDERMARKET: 1% of your investment for the first 30 days