February has been a month of returns and a few other joys 😉

It has just ended with optimistic news: Kuetzal’s insolvency administrator has returned almost €5.200, Lenndy has reappeared paying €4 after several months without news and Esketit has behaved exceptionally well.

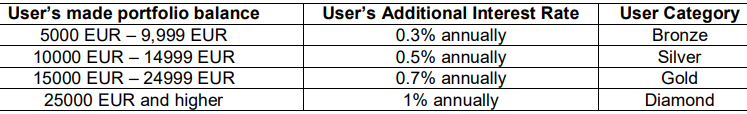

The €5.200 will go almost entirely to Peerberry to exceed the €10.000 threshold for the additional 0.5% bonus on each project and to Robocash to reach the €15.000 threshold and its 0.7% bonus.

Although this month has only brought in €459 in profitability, I am satisfied with the figures obtained, a prelude to an excellent March:

We haven’t had a single piece of good news from the damned Housers and it continues to be desperate with their slovenliness and bad work.

On the other hand, I used February to invest €3,650 in Peerberry, €450 in Bondster, €250 in Viainvest and Lendermarket.

Below you can see the profit obtained in February, the annual percentage of profitability and the total amount invested:

Here are the platforms that I am very satisfied with in green, somewhat less satisfied with in orange and undesirable in red:

Peerberry (+info)

Peeerberry brought me another €51 in February, which in March will be close to €80 after more than €10,000 invested.

As mentioned above, this figure will add an additional 0.5% to the percentage of each project invested.

This is the so-called Silver category, still far from the Gold (+€25K) or Platinum (+€40K) options:

Due to the events in Russia and Ukraine, they have stopped offering projects from these two countries and, in headline news, have exceeded €1 billion in funding and delivered €12M in returns to investors. ¡Bravo!

They remain second in terms of volume financed, with more than €207 million in the last quarter, behind only Mintos with €460 million.

If you want to invest in them, here they add 0.5% of your investment if it exceeds €500 during the first 30 days:

Viainvest (+info)

They have contributed €17 in February and it is one of the chosen ones in which I have increased the portfolio by €250.

They have more projects due to their new Broker Licence, in which investors have been brought under MiFID II regulation.

Investors can now be retail or professional and Viainvest is supervised by the Latvian Financial Commission (FCMC).

They are about to reach 28,000 registered users with an average of €3,119 invested in their projects.

A booming platform, they have increased their funded volume by 16.28% in the last three months, according to p2pmarketdata.com.

If you want to start earning, this banner gives you €15 just by investing more than €50. What are you waiting for? With only 50€!

Robocash (+info)

Another €137 that Robocash has given me in February! €768 contributed since November!!!! Olé, olé and olé.

But I am not satisfied with that and want to go beyond the €15,000 “Gold” category in March to earn an additional 0.7% per annum:

With such an amount invested, the snowball effect of compound interest, which has been giving me so much joy for several years now, is even more evident 😉

In the same vein, Robocash has published an article forecasting a 20% increase in P2P investments by 2022, with the wars and pandemics taking their leave.

I couldn’t help but comment that they have celebrated their 5th anniversary! Congratulations! And may there be many more…

They had considered downgrading their yields in March, but will wait a few weeks to see the extent of the conflict between Russia and Ukraine.

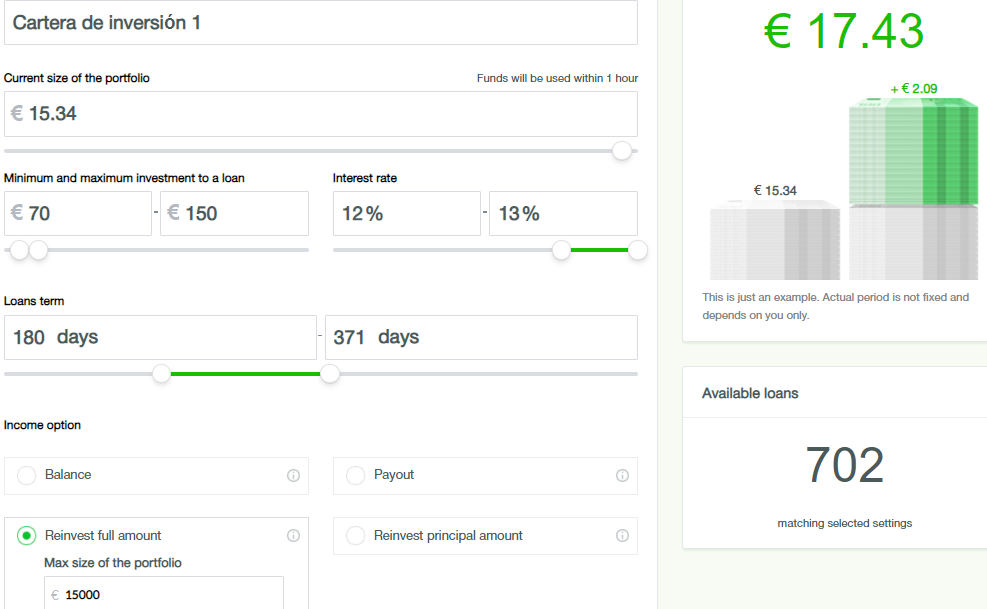

Since January I recommend investing in longer-term projects because they also pay interest once a month.

As a sample, here is my automatic investment chart:

I have increased the minimum investment period from the initial 31 days to the current 180 days to increase profitability. Also the minimum of €70 for each project

You can see that from 12% there are many projects (702) if you choose a longer term.

We are now over 23,000 investors and I am happy to have contributed 43 who I am sure will be as happy as I am with Robocash.

Don’t miss the opportunity to join them in this banner, where they add 1% of your investment if it exceeds 500€ during the first month:

Lendermarket (+info)

Another platform that is giving me a lot of joy and which I have rewarded with an additional €250 added to my portfolio.

I have already passed the €1,000 mark and with a return of 13.91%, I will be able to double the initial amount in 5 years. Not bad, is it?

Lendermarket has launched a 2% campaign for new investors with two conditions: invest more than €1,000 and in projects with a term of more than 11 months.

You can find all the information here.

If you want to benefit from their 2% promotion until 20 March, click on this banner:

Bondster (+info)

Another good month of Bondster which has earned me €6 and in which I have increased another €450, now over €1,000 invested.

His many projects at 16% for less than one year, in euros and with buyback are very interesting. Don’t miss them!

Of Bondster’s 27 originators, two of them are Russian, which cannot be invested in from autoinvest. Appropriate action.

Two new originators have joined Bondster:

- OK Credit, a Moldovan company specialising in short-term microcredit at 10-12%.

- Dyninno is a holding company with a presence in Russia, Romania, UK and Moldova with more than 350 employees. They have projects lasting an average of six months at 11%.

They have surpassed 15,000 investors and €93M funded in February.

Get an additional 1% from €100 of investment for the first 90 days:

Nibble (+info)

€4 was contributed by this platform in February with an initial investment of only €300 in April 2021 and a total of €44 in interest.

With almost a year of experience investing in them, I continue to be very satisfied with their results.

In two months I intend to expand my portfolio, as I am close to obtaining a supervisory licencefrom the Estonian FSA (Financial Supervision Authority).

I currently get a 14.5% annual return, but if you don’t want to take risks, take advantage of their classic strategy at 9.7% with Buyback and from 10€:

Esketit (+info)

I am still delighted with them and this month they have delivered €86 between profitability and affiliate bonus.

Keep an eye on it, because it has had a projection of 42.55% in the last quarter, as you can see from P2PMarketData:

They have invested over €31M and almost 400 new registered users in February, consolidating their good performance.

They devote a lot of resources to innovation and have therefore become the first platform to invest in “stable cryptocurrencies”.

In August I wrote a detailed article about this platform created by the founders of Creamfinance who have been in the market for 9 years and you can read it here.

They continue to keep their failed projects at ZERO and have already distributed almost half a million euros to the 1922 registered investors.

If you invest on this great platform, here is an additional 1% bonus for amounts over €100 for the first 30 days:

Estateguru (+info)

February did not bring any return because they pay in quarterly periods and I already received €24 in January.

In July 2021 I invested €300 and I invested another €300 in October. Now it’s time to wait until the summer to see how well they are doing.

This month they opened a technology office in Armenia and continue to deliver excellent results.

I already invested in 2018 with them, but they have improved a lot and their projects are really interesting and with few delays.

In fact, they have positioned themselves in the TOP10 for financing in EUR currency, with an accumulated €525M and more than 121,000 investors.

If you want to join them, in this banner you have a Welcome Bonus that brings an extra 0.5% to your investment for the first 90 days:

Kirsan Invest (+info)

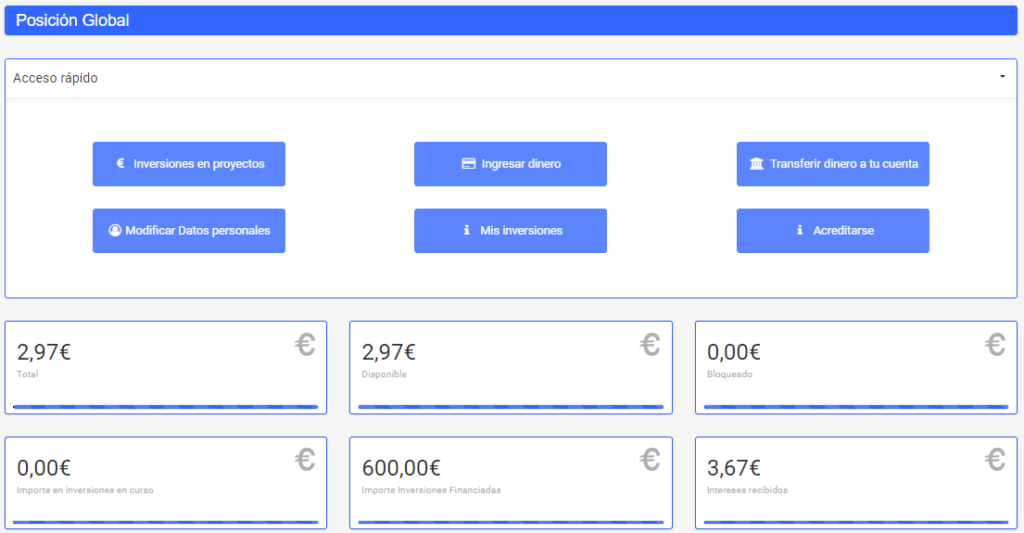

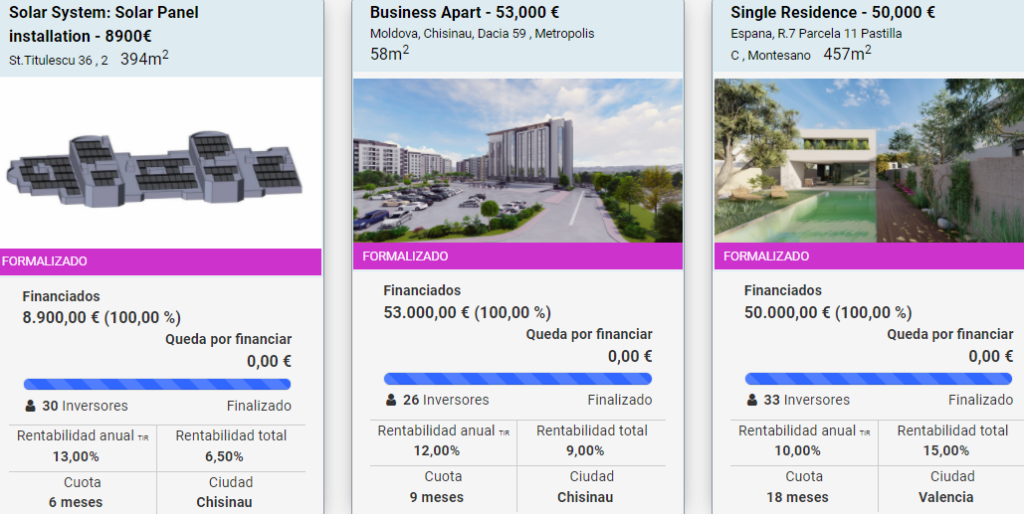

I have reached February with just over €30 in returns from the three projects in which I invested €600 in September for 6 months, 1 year and 18 months respectively, two in Moldova and one in Spain:

They currently have three projects under financing, at 12%, 13% and 14% annual returns, all in Moldova:

They continue to close projects with some dynamism and have already financed 12 projects with an average return of 11.76%.

In March they are planning a makeover of their website and in April they will surprise us with another new improvement.

There are no welcome bonuses at the moment.

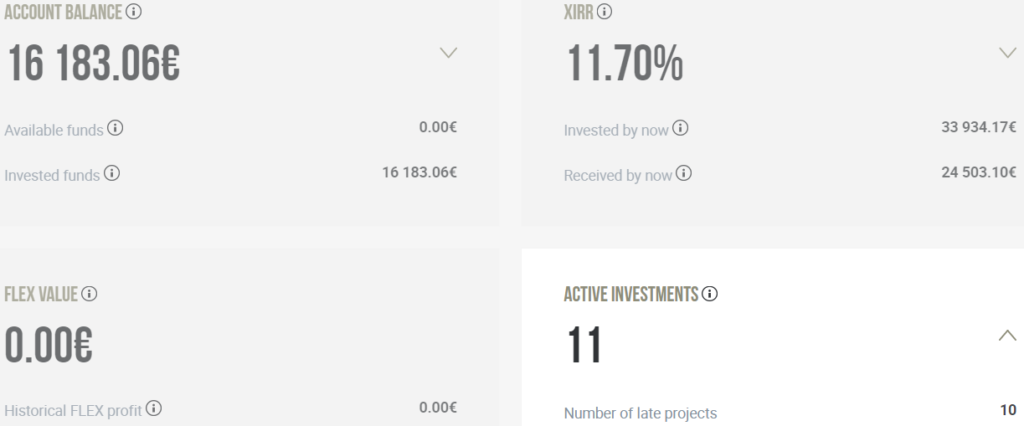

Crowdestor (+info)

This month they have contributed €144, but I still do not recommend investing given the delays and lack of information.

The only up-to-date project of the 11 I have invested in is supposed to finish in April – E. Fon Trompowsky Quarter – so I’ll let you know:

I do not recommend investing in this platform with an uncertain future.

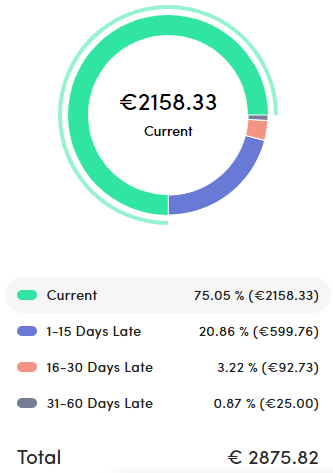

Iuvo (+info)

I only have €21 left to withdraw from this platform where I have not seen a return since I invested €200 over a year ago.

Of the 5 projects invested, 4 are in arrears and if the 5th project is also not paid on time, repayment will be delayed until 10 May.

I don’t think it is a recommendable platform, although I see that some people rely on it. For me an 80% project backlog is too much.

Maybe we will see each other in the future, but a lot has to change to reverse my opinion of them.

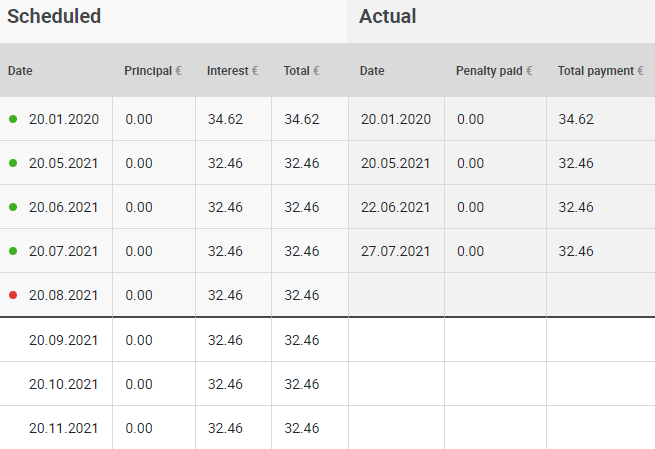

Mintos (+info)

Since October they have not returned a single euro and there is still €735 left which I hope to get back one day.

They are already licensed as a European investment firm regulated by the Latvian FCMC (Financial and Capital Market Commission), but their inefficiency in recovering our investments makes me wary of their management.

Mintos is still the leading P2P platform in Europe, but Peerberry keeps getting closer every month, and many of us are waiting to get our money back before running away…

Housers (+info)

What happened in Housers in February? Not much: they have returned a project, the courts are unable to send them notifications because they have no known address, and they still do not offer solutions to the dozens of projects that are still blocked.

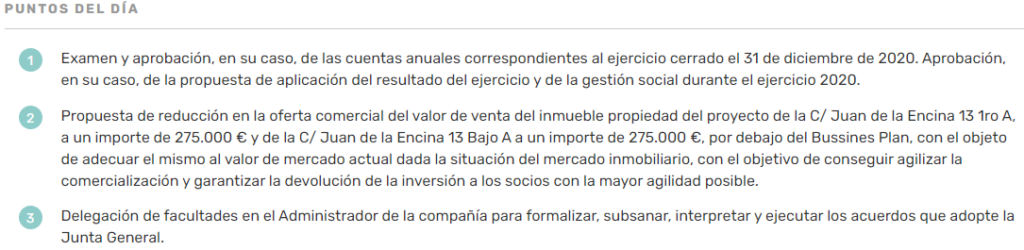

I will give you an example of the Juan de la Encina project, which ended its vote on 23 February:

- Review and approval of the 2020 annual accounts. 13 months later? Yes, it does.

- Proposal for a reduction in the price of the project. What profitability will they publish next?

- Let’s leave it up to Housers’ proposed Administrator to do as he pleases. This is the summary.

And now, those of you who are unwary and want to continue investing, go ahead! But don’t say that we haven’t been warning for years about the lack of transparency in Housers.

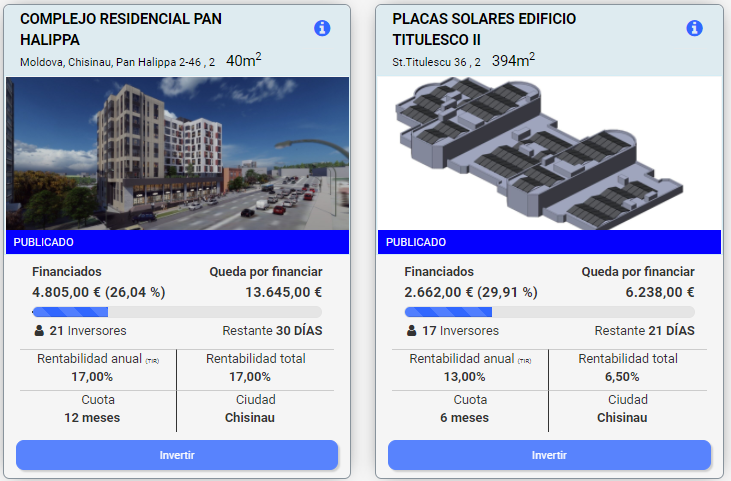

Bulkestate (+info)

Finally, it seems that the project that was supposed to be finished 12 months ago, Amalijas Street, will be completed in March.

I see that in one month they have dropped from 49th to 51st in terms of volume financed and that means a lack of confidence in their projects.

Here is an example: on 10 February this project was opened at a 15% return and with 5 days to go before the end of the project, 45% of the project remains unfunded:

My personal opinion is that Bulkestate has failed to communicate to its investors in the face of the delays. Maybe it will pick up in the future, but I doubt they will be able to count on me by then.

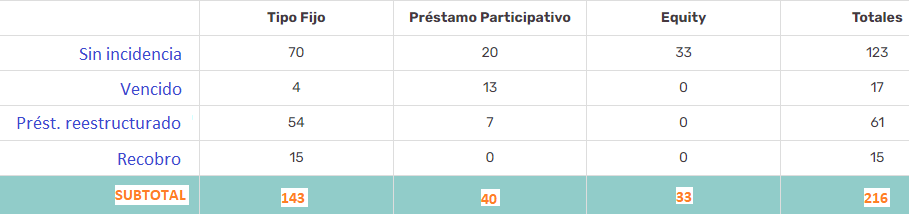

Crowdestate (+info)

Other platforms have lost investor confidence due to the accumulation of failed and delayed projects.

On a personal level, the auction ended on 15 February and after two weeks we still do not know what has happened. No news.

The December auction must have been repeated because there were no takers, so I hope to be close to repaying the €2,600 I invested more than three years ago.

On the other hand, I still don’t know why the latest annual accounts date from 2019. Weird, isn’t it?

They continue to accumulate projects that are overdue or cannot be repaid. Let’s see how far they will go…

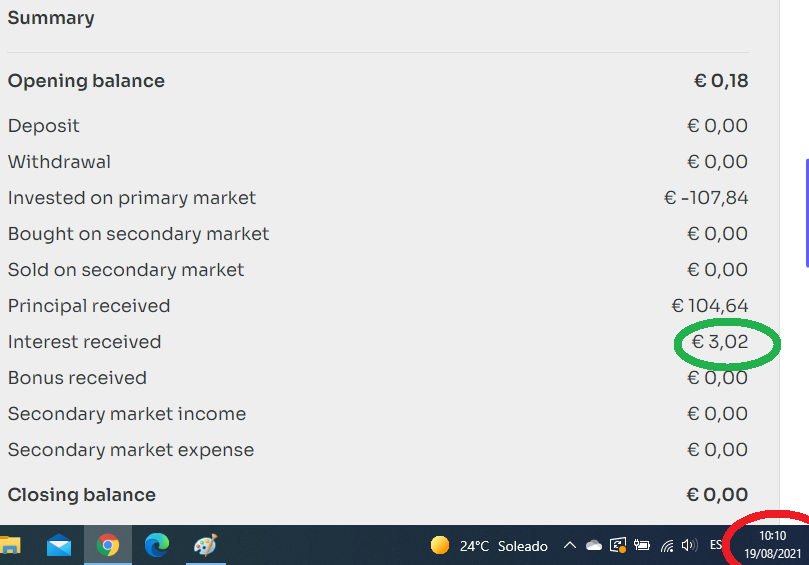

Lenndy (+info)

They returned €4.56 in February, which is great news, because I haven’t seen a cent since July 2021.

At this rate, however, they will not be finished by March 2024 as planned and we will have to wait a few more years. As long as they pay, welcome.

Kuetzal (+info)

After several years with an outstanding debt of €19.155, the insolvency administrators have begun to make refunds to those affected.

In my case they have refunded €5,132, equivalent to 26% of the total due. We do not know the date of the next payment and the amount of the next payment.

This has been my greatest joy this month and I hope to receive some more this year from Monethera or Envestio. Fingers crossed.