Yes, this could be the summary: a few joys in a satisfying month of August.

And I can feel satisfied even though I only got €705.

The reason is that a Crowdestor project has been repaid in full and Housers has repaid the Albufera project, among others.

On another note, I have received a financial contribution that will be reflected next month on various platforms. Whenever I can increase my crowdlending portfolio, I don’t miss the opportunity.

And I am patenting an idea that will hopefully be well received and bring me a lot of satisfaction.

Finally, I have started investing in Estateguru, but I will not update the information until September.

I can be happy with the results of the last three months, totalling €2.353:

And now, let’s get to the month’s news, with big news from some of the platforms:

The BEST and recommended platforms with welcome BONUS

Peerberry (+info)

On the verge of getting the crowdfunding licence in Lithuania, Peerberry keeps growing and giving me good news.

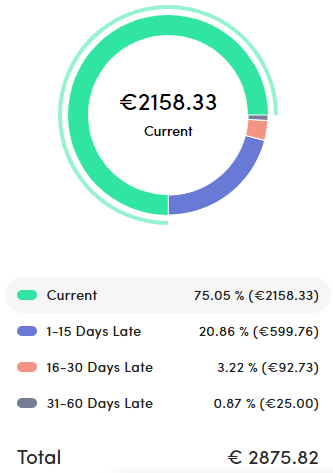

This month they have contributed €42 and are keeping the arrears at bay, as you can see here:

We have heard that they intend to launch a secondary market and that they also want to obtain the EMI (Electronic Money Institution) licence to become a payment provider.

This month they have also activated push notifications on their mobile app, with new deposits, withdrawals, uninvested amounts and others.

It remains the second largest platform by volume financed, with more than €48 million, behind Mintos with €150 million.

And finally, I reflect here the news that the Aventus Group, of which Peerberry is part, earned €13.15 million in the first half of 2021.

My goal at Peerberry is to reach Silver status (€10K) which offers an additional +0.5% and which I hope to achieve before December 😉

Here they add 0.5% of your investment if it exceeds 500 euros during the first 30 days:

Viainvest (+info)

Another €25 has been brought to me by Viainvest in August and I have taken profit from the additional €350 I added in June.

They have let us know that they have set an 11% interest rate on all their projects from 1 September.

They are also about to obtain their broker’s licence (IBF) and I will continue to grow my portfolio with them to €3,000 by the end of the year.

In this banner you get €15 just for investing more than €50. What are you waiting for? With only 50€!

Robocash (+info)

70€ earned on Robocash! New this month was the interview I conducted with Dmitry Balakhnin, director of strategic communication.

In it, he unveiled some new features, which you can see here.

This month Robocash has already entered the TOP 10 platforms by funding with a total of €12 million.

We are already 18,000 active investors on the platform and almost 700 new ones joined in July. I am not surprised!

In September I will increase my portfolio by €1,000, bringing me closer to Silver status, which brings an additional 0.5% with €10K invested.

In this banner they add 1% of your investment if it exceeds 500€ during the first month:

Lendermarket (+info)

This month it has returned €4 with only €415 invested and maintains its return above 14%.

August brings some news: Credistar Group, parent company of Lendermarket, has applied for the specialised banking licence.

In addition, it has placed more than €23 million in bonds, coinciding with its 15th birthday.

And in the second quarter, net profit exceeded €2 million.

It is a company to keep an eye on and is ranked 12th in terms of turnover with €11 million.

If you want to benefit from their 1% welcome promotion, click on this banner:

Bondster (+info)

Bondster returned €5 in August, I am satisfied and am looking forward to increasing my portfolio to €1,000 before the end of the year.

NordCard has increased its profitability by 1% and Lime South Africa has finished paying last year’s outstanding amount.

As far as we have been able to ascertain, the average number of projects in arrears is less than 0.1% in Bondster:

They have reached 13,000 investors and more than €3.1 million in interest.

Get an additional 1% from €100 of investment for the first 90 days:

Nibble (+info)

I continue to be delighted with this easy-to-use platform which brought me a record €13 in August and about which I wrote a detailed article last month.

In total it has generated €22.82 since mid-April and is the platform with the highest return of 14.5% per annum.

This month I have been invited to take part in an internal survey that promises great things to come.

Nibble is currently in the process of obtaining the AML (Anti-Money Laundering) certificate.

They have also applied for a supervisory licence from the FSA (Financial Supervision Authority) of Estonia.

Remember that their classic strategy offers 9.7% with Buyback, with NO risk and a minimum investment of €10:

Esketit (+info)

It has contributed €3.80 in August and is already bringing me my first joys.

Its Buyback works without delays, it is easy to use and its autoinvest works autonomously so you don’t have to worry about it.

A couple of weeks ago I wrote a detailed article about this platform, which you can read here.

It is a new platform, but created by the founders of Creamfinance, with 8 successful years in the market.

Here you get an additional 1% bonus on every investment over €100 you make during the first 30 days:

Platforms with some shadows, not recommended for investment

Crowdestor (+info)

Although this month Crowdestor has only given me 21€, I am satisfied because they have returned the Forestland Investments project in full.

As of today I have a backlog of 11 projects out of 12, of which I have 5 for sale on the secondary market.

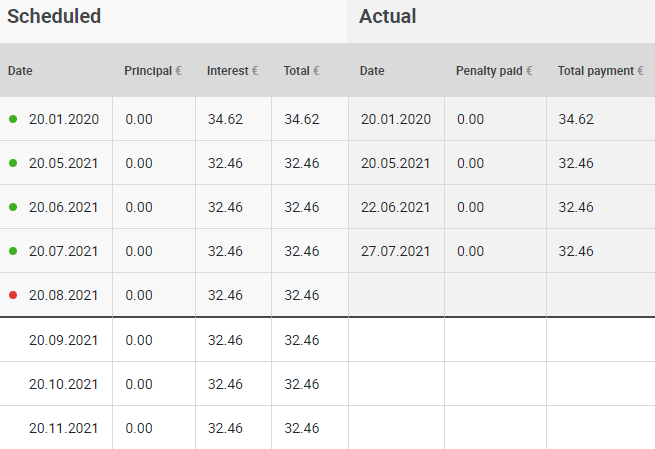

It is a pity that the E. Fon Trompowsky Quarter project, which was up to date until August, has not been paid this month:

The payment schedule now has this new design, but the tricky thing is that non-payments are still accumulating.

The M119 project should be completed in September, but I am afraid they will not pay on time because they are already 4 months behind schedule.

They have also embraced Auto Invest, which is now available on the secondary market. I do not recommend using it on Crowdestor.

Here you can see the status of the projects in July and below as of today to draw your own conclusions:

Until they reduce their high default risk, I do not recommend investing in this platform.

Iuvo (+info)

This month it has only returned €2 and I still have serious doubts about this platform.

Investments in roubles have not been a great incentive either and, although returns have increased, I see little difference.

In short, I will wait another month to see how it evolves. It is still a platform that I have been testing since December.

The good news is that Easy Credit and Viva Credit are lowering their Buyback from 60 to 30 days, but at a yield between 5-6%, far from my expectations.

In any case, I do not recommend investing in it today.

Don’t even think of investing in these platforms

Housers (+info)

This month Housers has fulfilled some commitments: Albufera III, Juan de la Encina and Pensamiento.

BUT, it has again defaulted on six other projects, one of which has not delivered a single cent since it was funded in March 2018.

One is particularly serious because the developer Construbecker was given a second chance to fulfil its non-payments, so we will have to wait until the complaints made against it are successful.

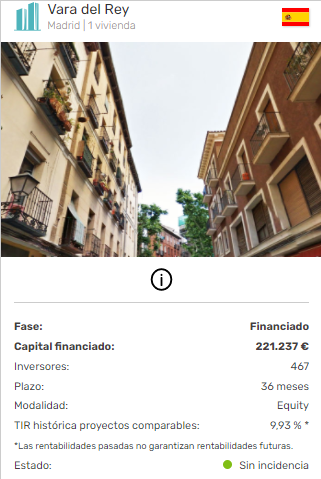

Several investors affected by the Vara del Rey project have joined forces to recover the administration of the company, but neither Housers nor the administrator seem willing to call an extraordinary meeting.

And the most curious thing is that on their website this project appears “without incident”, although it should have been returned in April 2020.

And since we are delighted with its management, we want to manage it ourselves as investors, despite the additional costs involved.

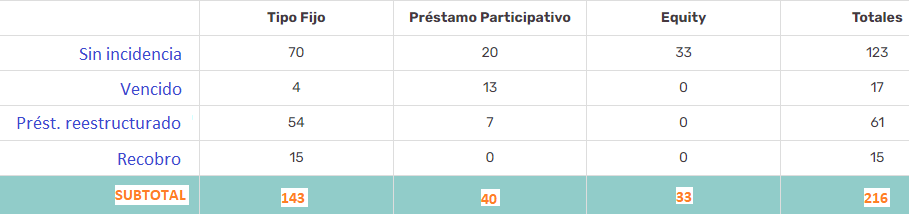

Many of the 123 “uneventful” projects should have been returned years ago, but they are not considered “overdue”:

Some “uneventful” examples that I personally suffer from:

- El Raval II (expired in February 2020)

- Sagasta (expired in January 2019!!!)

- Pensamiento (expired in January 2020)

- Juan de la Encina (expired in June 2019)

And to complete the current situation, I leave you with this latest example of their inability to pay back their funded projects:

Bulkestate (+info)

They have not launched any projects in August and seem to have taken the opportunity to rest, as there has been no news from them either.

My project will be returned a year late and, since they have no secondary market, I can only wait.

At least they have published some photos of the evolution of the project, although I see it very late and I don’t know if they will finish it in March 2022.

Mintos (+info)

I have been refunded €32 this month and there is now €773 still to be recovered, mostly from Finko AM.

The good news is that Mintos has been licensed as a regulated European investment firm by the Latvian FCMC (Financial and Capital Market Commission).

In addition, it has new Russian originators Pay P.S. and Capem; Conmigo Vales, GoCredit and Alivio Capital, all from Mexico, as well as Jet Finance and LF Tech, both from Kazakhstan and Watu Credit, now also in Uganda.

Mintos remains the leading P2P platform in Europe, with €150 million funded last month.

I continue to withdraw my portfolio, as the investment in one of the TOP originators at the time left more than €1,000 in the process of recovery, of which I will recover a maximum of 70%, as announced.

Lenndy (+info)

This month they have not made any repayment of the 783€ of outstanding capital and it has taken them three weeks to transfer 4€ from last month.

I must be patient, as the outstanding amount will not be refunded before March 2024.

In May I put my two assets up for sale at a 21% discount, but no one has yet been interested. I am not surprised either.

Crowdestate (+info)

This month there has been no news from Baltic Forest’s insolvency administrator and €350 of accumulated interest remains to be paid.

Something has to change at Crowdestate since the EFSA (Estonian Financial Authority) granted them the certificate of regulated payment institution in June.

In August they have been very active, launching 11 projects and successfully returning 3.

But let’s not forget that they have more than 10 million outstanding on 21 overdue projects and more than 3 million on 5 unpaid projects.