My portfolio update: March 2021

Yes, a month of records. March surpassed the highest return achieved in December 2019 with a magical sum: €2,297.

And, incredible as it may seem, this month Housers has returned €2,055 of four months of delays in the Albufera III project. That said, we may not see a euro for months, which is the usual scenario.

I don’t know if it has anything to do with the complaint that I ratified this month before the Madrid Courts against Housers and the Albufera III developer, but it seems a pleasant coincidence.

March has brought a lot of news about Housers, which you can read below.

In reference to Peerberry, this month it has continued to give me joy, as it has brought me €69 between interest and bonus, a new profitability record on this platform.

In addition, this month they have launched their mobile app, closed their first real estate project, and continue to increase their financed volume, number of investors, etc. every month.

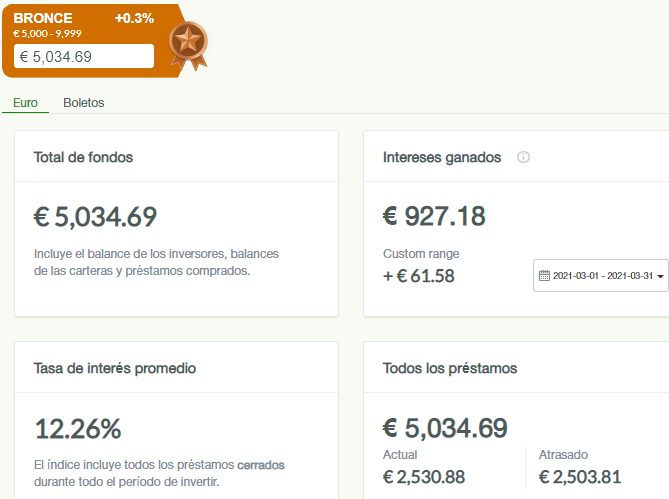

Robo.cash has been another tremendous success, because I have reached the bronze category (over €5,000 invested) which entitles me to an additional 0.3% interest, earning me €61.

They have several new developments: this year they will open a market in Sri Lanka and are creating a digital bank. The 2020 audit will be presented around May-June.

Crowdestor has disappointed me this month because of continued delays and non-payments and professional miscommunication, despite having received €90 in interest.

In March they reached €50 million in funding, Artur Geisari (head of SME) has left the company and they have launched Crowdestor Club for those with investments over €75,000.

They have just announced a new procedure for the collection of every overdue or unpaid project. You can see it here.

I also give a positive to Bondster, which this month has paid €10 in interest, introduced its new CEO (Pavel Klema), has new originator (Autofino) and received excellent feedback from P2Pinvesting.it and Capital Insider.

Viainvest continues to hold its own and has suffered less fallow this month, paying €8 in interest.

Iuvo has also complied and since this month I am “testing” rouble investments with an interest rate above 19%. All projects are up to date and are made in the well-known originator Kviku.

Lendermarket continues to run its course and with the expected profitability, without surprises.

On the other side of the coin is Lenndy, which this month invented a way to make the backlog of projects disappear by moving them into one portfolio for First Finance projects and another for Giantus projects.

I was also disappointed by Bulkestate, from which I expected the return of the project invested a year ago and which will be delayed for a few months. We were not informed until the expiry date. Painful communication.

Mintos, which has refunded me 10€ of the overdue amount, was not to be missed. A lot of marketing and inefficient collection management, with €961 (all my capital) in the process of recovery. Another one I don’t recommend.

Crowdestate has still not contributed a single euro for more than a year. There have also been no developments in the bankruptcy proceedings of the company in which I have invested my capital.

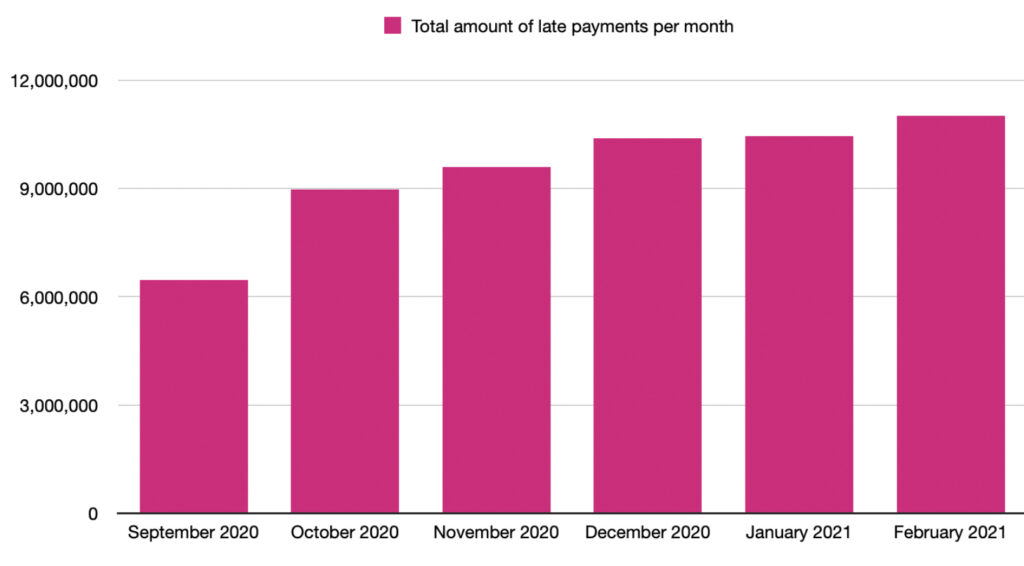

They remain €11.8 million in arrears and €1.9 million unrecoverable from four projects.

This month we have also received nothing from the reported fraudsters Grupeer and Wisefund, whose news I publish below, along with the confirmed fraudsters Envestio, Kuetzal and Monethera.

Here’s the current status of my investments:

This month ESMA (European Securities and Markets Authority) has introduced a technical consultation affecting Crowdfunding service providers for investor protection based on the ECSPR (European Crowdfunding Service Providers Regulation).

They should get a response before the end of May, so the long-awaited regulation that will mark the potential future of Crowdfunding is coming.

Housers (extended version)

There have been MANY news this month. The first is that they have deigned to pay several months late for the Albufera III project. Of the other eight projects, they haven’t paid anything.

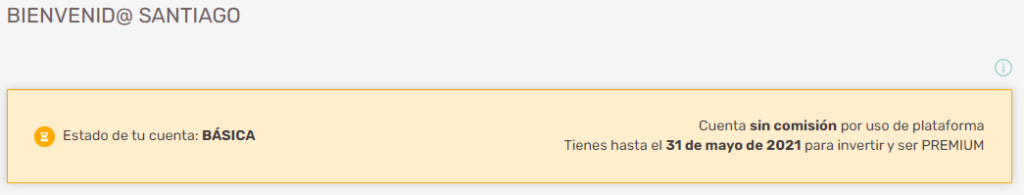

Since March 29, this appears in our access panel:

This means that we will be charged a fee of €2.5/month for the use of the platform if we have not invested or registered in the last year. Is it legal? Apparently not. You can avoid this charge by keeping the account at zero.

On the other hand, according to an official statement, Housers will no longer charge a 10% commission for the distribution of interest or profits in its projects from 29 March. Previous projects will continue to suffer from this commission.

This month they returned the project number 105. They are also going to sell Santa Eulalia assuming a loss per investor of 11.7%. What they have also failed to publish is that 129 projects have been delayed or unpaid, some for 46 months (almost 4 years). Here is a sample:

You can see the complete file made by Luís Ballesteros, president of the Association of Affected People by Housers, downloading this pdf:

On the other hand, Housers has published a list of 21 defaulting developers, with debt or in recovery, which you can see here. But after reviewing the 129 projects with incidences, there are many missing in this list.

At the beginning of April, the lawyer Manuel Merino, who is suing Housers and various developers, will file a new class action criminal complaint for fraud and corruption in business that will affect 33 projects.

These include San Raimundo, Mercado Central, Iriarte (where I will also file a complaint) and Plaza Castilla, which affect thousands of users. You can check the 33 to be reported and see how to sign up on Facebook or Twitter.

If you have any doubts about how to proceed, you can contact me by email at info@libertad-financiera.eu.

There are also two very active Telegram groups to know all the news: https://t.me/housers_foro and https://t.me/housersCom

MOST RECOMMENDED platforms: Peerberry and Robocash

Peerberry (extended version)

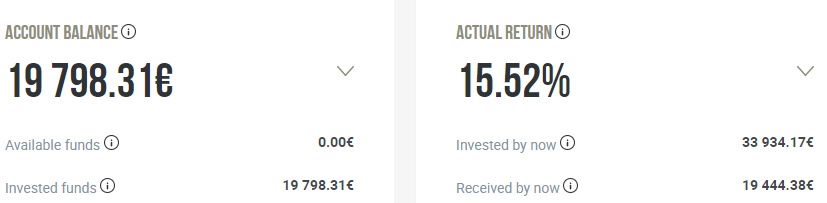

March has brought pleasant surprises, such as €60 in bonuses and €9 in interest. Together with Robocash, it is the platform on which I am deriving my portfolio and little income.

They have also launched a mobile app, which I don’t see much use for, as their mobile website is very easy to use.

They have closed their first real estate project and have taken a liking to it, because they have just launched another one with a yield of 11.5% over 12 months.

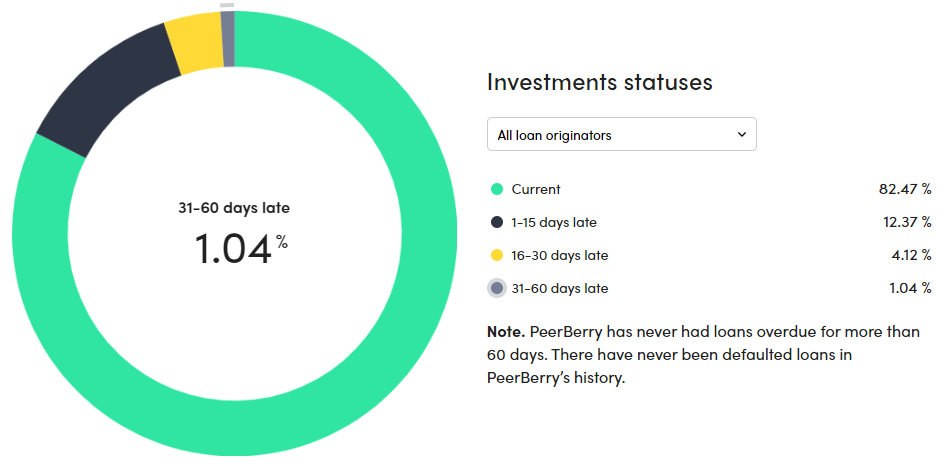

In March they have reached 5.3 million euros of interest paid and here is a sample of the status of their projects, with 82.47% current and 1.04% overdue between 31 and 60 days:

I expose my dashboard as shown:

get here 0.5% of your investment for the first 30 days in PEERBERRY

Robo.cash (extended version)

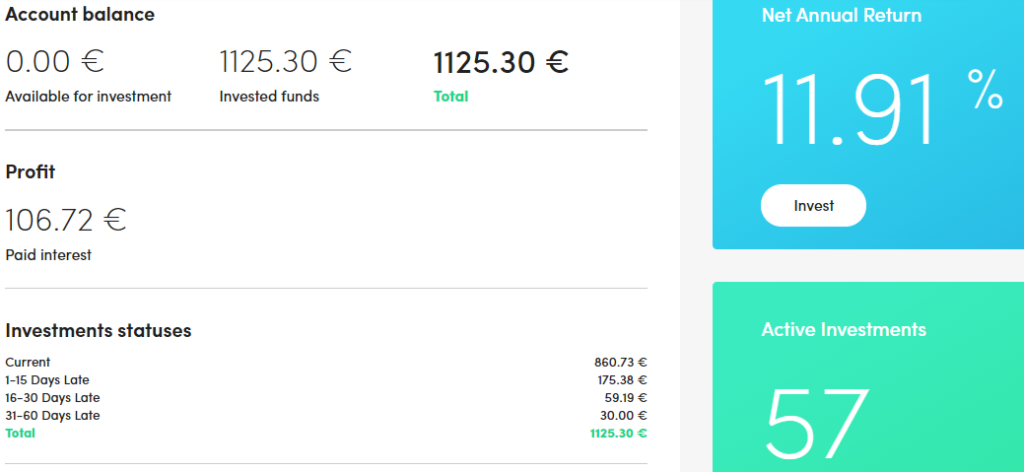

This month I have increased my portfolio by €1,163 to reach the bronze category which gives an additional 0.3% to each project:

If everything goes on like this, maybe this year I’ll achieve the silver category. Step by step. At the moment, I am content with the €61 interest earned in March.

From 16 April, there will be changes to its secondary market, which will allow the sale of any project on any date (from 180 days until now) and without any commission.

They have published their excellent results in 2020 and hope to double them this year. They are committed to presenting their audited annual accounts between May and June.

I now have a return of 12.26% which you can see below and the bronze label commented:

get here 1% of your investment for the first 30 days at ROBOCASH

Also RECOMMENDABLE platforms (but less so): Crowdestor, Viainvest, Bondster, Iuvo and Lendermarket.

Crowdestor (extended version)

It has given me little joy, with many delays in payments. Specifically, 75%.

€2,077 of the Renewable energy project (RAM 61.9ha) was due for repayment on 30 March, but they have extended it by 6 months, although they have already announced that the repayment of 3/4 of the total amount will not be paid until the end of the year.

The Mafia Stars project, which is supposed to have been VERY profitable, ended three months ago. They have paid small parts every three weeks, except in March, which they have already defaulted on. They say they’ll pay for it after Easter.

The Consumer Loan Portfolio Acquisition project ended on 13 March and they owe €1.2 million in interest and principal since November. Crowdestor has bought the entire portfolio and says it will be sold when the Georgian economy recovers slightly.

And so I could continue with the rest of the projects in arrears, although we may collect interest or principal on any of them at any time without prior notice.

This is a complaint that all investors share, as the responses in their communications are far from professional and are now all focused on their new collection procedure, which you can see here.

Small red flag: Artur Geisari (head of SME) has left the company somewhat hastily because of the bad press he was receiving due to conflicting interests.

In addition, and as a novelty for those lucky and few daring investors, they have launched Crowdestor Club for those who hold portfolios above €75,000.

And here’s a screenshot of my current situation:

They remain unique when it comes to project finance: they currently have 9 assets offering between 12% and 36% from 6 to 12 months and have two about to go public. Good for them!

get here 1% of your investment for the first 90 days in CROWDESTOR

Viainvest (extended version)

If it were not for the fact that it sometimes suffers from the lack of publication of projects, it would be in the TOP 3 of my favourites, because it still provides a lot of security.

This month they seem to have published projects on a more regular basis and I am more than happy with the €8 paid in interest.

Like Mintos and Peerberry, their plan remains to obtain a IBF license to comply with the new European regulations in 2021.

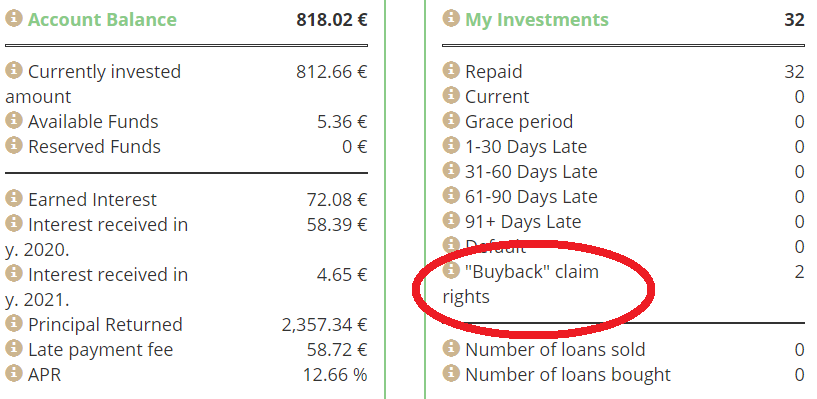

In February I had a portfolio of 32 loans, of which only 5 are in arrears. They are essentialto achieve financial freedom and at a current yield of 11.94%:

get here €15 bonus with a minimum investment of €50 on VIAINVEST

Bondster (extended version)

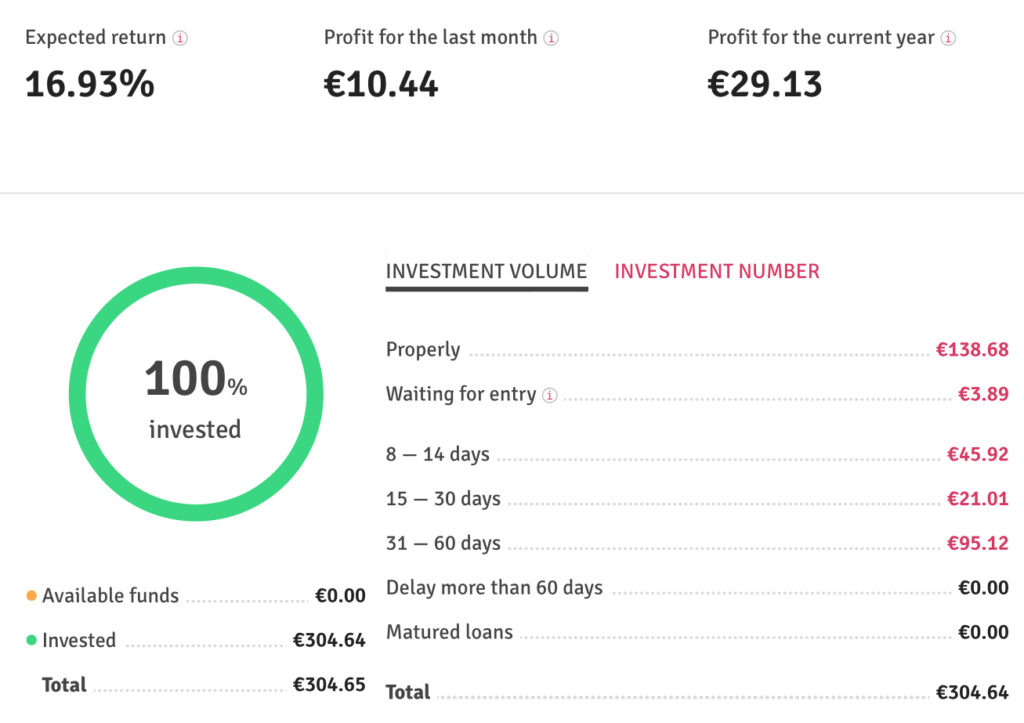

In February I reduced my exposure on this platform by €387 and in March by a further €250.

I now have just over €300 invested which I feel comfortable with, as I didn’t like the changes at the beginning of the year, but communications seem to have improved and it is still the platform with the highest annual return.

This month they introduced their new CEO, Pavel Klema, formerly of Profi Credit and Air Bank.

In addition, since March, they have a new Lithuanian originator specialised in leasing vehicles with Buyback that also serve as collateral: Autofino.

In January I withdrew the Welcome Bonus until the platform situation stabilises. If they continue to deliver smoothly in April, I will republish it.

Here’s my current situation:

Iuvo (extended version)

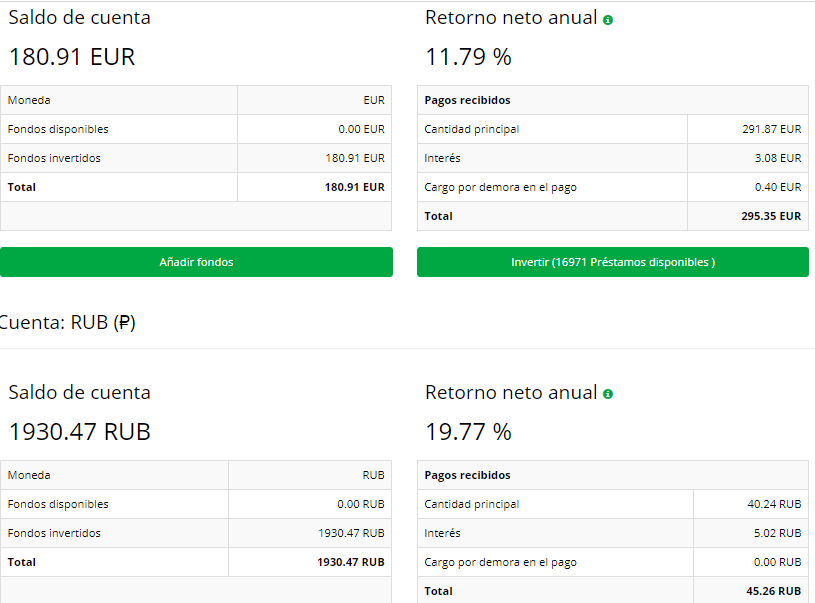

I have completed three months with Iuvo and the balance is positive, but due to the low initial investment (€200), there is hardly any profitability.

Therefore, this month I started investing in Kviku’s rouble projects, which offer more than 19%. The best thing is that they are all up to date, compared to those in euro, with more than half of the portfolio in arrears.

In January I got 10.65%, which increased to 10.96% in February and in March to 11.79%. All this in euros, while in rubles it shoots at almost 20%.

Here you can see it in detail:

This month they have a welcome promotion in which they offer 1.5% of the amount invested from €1,000. If you invest this amount, they give you 15 euros.

To take advantage of this bonus, you must write to me at info@libertad-financiera.eu

Lendermarket (extended version)

March brought little news, with the exception of the increase in profitability, which rose by half a point.

I have edited Autoinvest so that it only invests in projects at 16%, so I hope to catch up in a couple of months.

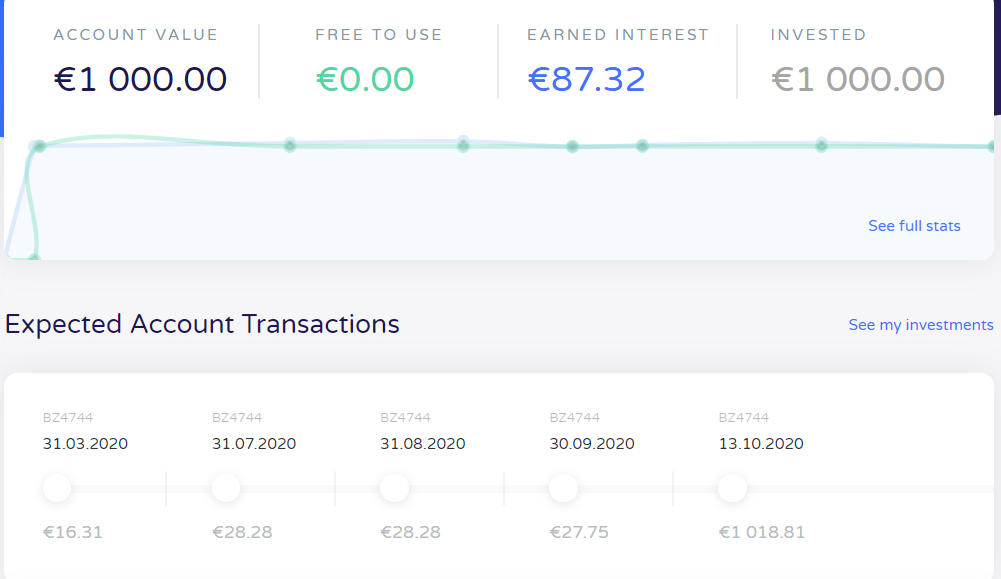

In December Ideposited 300 euros on this platform and after three months, this is my dashboard, which has hardly any delays:

get here 1% of your investment for the first 30 days in LENDERMARKET

Platforms NOT RECOMMENDED: Lenndy, Bulkestate, Mintos and Crowdestate

Lenndy (extended version)

This month they have gone too far and made the backlog of projects disappear by moving them to two portfolios, as I show you below:

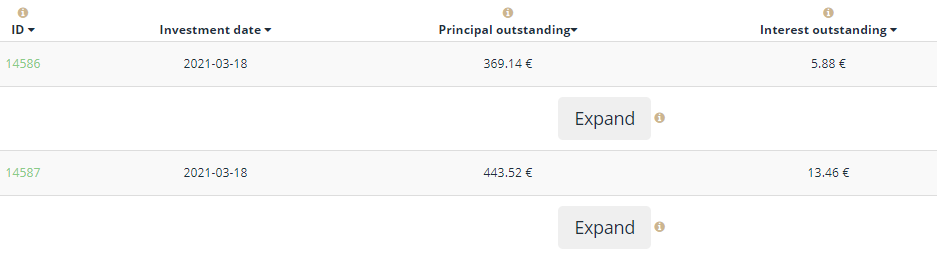

When you open them, one shows First Finance projects for €444 and the other shows Giantus projects for €369. Here is the sample, inside the “Portfolio” tab:

In a FAQ section they anticipate that they will publish the payment schedule in early April.

Since March they have stopped issuing loans with Buyback.

At the moment, they do not have the confidence of investors. I do not recommend investing in this platform until further notice, although I understand that they will be able to pay the payments as they have the financial backing of the Giantus Group.

As of 2 February they have a secondary market, so if you want to get your money back immediately, please note that each sale carries a 5% commission.

My position is to withdraw everything invested in this platform until the situation is resolved. By logic, I’ve removed the bonus for new users.

Bulkestate (extended version)

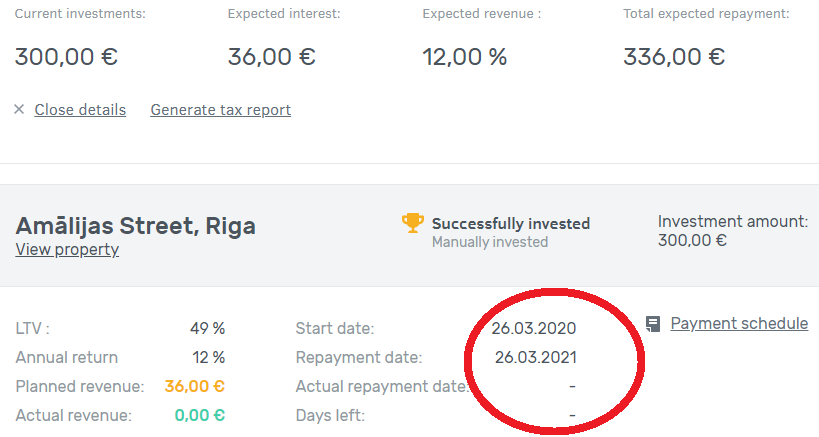

The project in which I have €300 invested has been delayed and they say they will pay in the “next few months”. I have asked them how many, but still no answer. For the time being, it’s time to wait:

It takes a long time because they hardly publish projects with monthly payments, and they publish very few projects. There have only been two in March and one is not going to reach 100% funding.

In fact, on 31 March they raised the yield to try to finance it, which shows that investors have reduced their confidence.

In my case, this delay has put me off investing with them for the time being, so when I get paid for this delayed project, I will say goodbye.

This month they have a welcome bonus, but I don’t publish it as I don’t recommend investing with them.

Mintos (extended version)

Another 10 euros returned by Mintos this month of the tedious recovery process, as in February. At this rate, I’ll get my total back in eight years.

It is still the platform with the most money funded, but it has given me nothing but headaches. And some investors still recommend it. I don’t get it.

In March they launched the investor forum, where you can ask, share and discuss. You have to register and you can do it here. I have already started asking why there are hardly any payments from the originator Finko AM. No answer.

I have removed the welcome bonus from my blog, as I do not trust Mintos and their recovery policy. At the moment, I do not recommend investing with them.

If you really want to invest in Mintos, which I do not advise, go to this website to verify that you are investing in originators with a score above 65.

My profitability continues to fall month by month and stands at a lousy 5.64%:

Crowdestate (extended version)

In March, 7 new projects were published, but I am still not investing in them because they do not return any capital or interest from my three projects associated with the Baltic Forest company.

They already owe me 182 euros behind me according to their own payment schedule. No comment.

It has been more than two years, when its duration was 12 months, so you won’t see me investing in or recommending this platform.

As of March there has been no progress by the Bankruptcy Committee dealing with this company.

And they continue to accumulate delays in their payments: 11 million euros as of March 1

Crowdestate also has 1.9 million irrecoverable from four projects: Metsa Tee 31/33/35, H.M. Seafood I and II and Estera Development Holding.

Platforms INVESTIGATED FOR SCAMMING: Wisefund, Grupeer, Monethera, Kuetzal and Envestio

Wisefund – possible scam (extended version)

They seem to have disappeared. They released two projects at the beginning of the year and have not shown any signs of life since.

The alleged debt recovery company Cis Debt Recovery Solutions has not been heard from either, if it ever did any work at all.

As of 30 March, the interest for March, July, August, September and October of the Dutch Flowers project, which amounts to €118 and was due on 13 October, has still not been reported or paid:

There is already a class action lawsuit against the platform among all potential affected, initiated by the law firm Magnusson that already works in the cases of Envestio, Kuetzal and Monethera.

At the moment, the most up-to-date information can be found here. If you are interested in accessing the lawsuit, you have to wait for the bankruptcy to be declared.

Then a new round will be opened to join the complaint group, but you can go ahead and join the waiting list here. They say they will be open to new claimants at the beginning of April.

Grupeer – possible scam (extended version)

They have reappeared with two new blogs, this one dated 03/03 and this one dated 31/03/.

In short, they claim to have sued two of their originators and are preparing eight others, while Mikrokasa is being restructured under the supervision of a court.

They also claim to have received an acceptance of debt from one of the main defendants, but do not say which one.

At the same time, the investors’ law firm in Latvia (Ellex Klavins) continues its offensive against Grupeer and the loan originators.

Ellex’s initial request has been to see Grupeer’s financial statements and to carry out an external audit of all originators which has not yet been completed.

Precisely, from this office they have sent a document to be filled in by ALL affected investors, regardless of whether they have filed a complaint or not through them or through another law firm.

This document is to be sent to the embassy of each country in Latvia in order to put pressure on the authorities and to get them to address the constant scams they are suffering from. I have sent it to the Spanish Embassy in Latvia and I have received the following reply in just 2 minutes:

“We are aware of the case from other similar communications from other affected persons. If your legal representative in Latvia would like to make an appointment to present your case, please contact this Embassy to arrange it”.

On the other hand, if you want to join the waiting list for the Ellex Klavins class action lawsuit, here is the direct link.

Monethera – confirmed scam (extended version)

The law firm Magnusson already has the movements of all banks involved.

It is time to press for bankruptcy filings for all debtors in order to recover the assets that can be seized from them.

Envestio – confirmed scam (extended version)

It seems that the Magnusson whistleblowers have positive news regarding some of the originators.

There are several properties and vehicles in the portfolio that after their sale will swell part of the funds to be returned to those affected when the Court determines it.

The Court has already summoned some debtor companies in September 2021.

Kuetzal – confirmed scam (extended version)

Kuetzal has a more complex network, with companies in Estonia, Latvia, Russia, several countries in Central Europe and Hong Kong.

Criminal lawsuits against the Central European companies are about to be filed, while in Russia a law firm has already been hired to initiate the lawsuits there.

A number of properties and vehicles have also been blocked to cover part of the funds to be recovered, although for the time being these are very insufficient.

As with Envestio, of which Kuetzal shares some entities, decision-makers and fake companies, I cannot give more details so as not to give away the work that is being done, but progress is being made.