I was dreaming about the arrival of October, because it was the month of payment of the Albufera project that Housers should have paid, but oh, surprise! We have not been paid! It was too good to be true.

In any case, I do not consider it a bad month, as it is the fifth consecutive month of over €700 per month.

Specifically, it was 761€, as you can see in this graph:

On the other hand, I am happy because I have invested €3,774 collected from an indemnity that will soon start to provide returns.

I have diversified it among six European platforms that I have full confidence in and which already exceed a portfolio of €42,000.

In addition, two platforms have released their profitability box this month: Estateguru and Kirsan Invest.

This is the October income, its profitability and the total invested:

And now for the platforms that I am very happy with in green, somewhat less happy with in orange and undesirable in red:

The BEST and recommended platforms with welcome BONUS

Peerberry (+info)

October has brought in a very welcome €65 and will be even more in November as I have added another €900 to the portfolio.

With this amount, I have deposited €3,100 in the last five months in their portfolio and the confidence they inspire in me is enormous.

They are continuing with their plans to launch a secondary market and also to obtain the EMI (Electronic Money Institution) licence to become a payment provider.

It remains second in terms of volume financed, with more than €56 million, behind only Mintos, with €153 million.

Here they add 0.5% of your investment if it exceeds €500 during the first 30 days:

Viainvest (+info)

Another €25 contributed by Viainvest in October, a month in which I increased my portfolio by €300 to €1465.

Due to its new Broker Licence, as of 5 November, investors will fall under MiFID II regulation.

Thus, ordinary investors can be either retail or professional and Viainvest will be supervised by the Latvian Financial Commission (FCMC).

In this banner you get €15 just for investing more than €50. What are you waiting for? With only 50€!

Robocash (+info)

This platform is going great! In August it gave me a €70 return, in August it was €95 and in October I got another €106!

And of course, I have increased my portfolio by €1,874 in October, thus surpassing the €10,000 mark, which brings me an additional +0.5% return.

It has been an exceptional month, exceeding €15M financed and paying out more than €305K to investors, of which there are now more than 20,000.

Don’t miss the opportunity to join this banner, where they add 1% of your investment if it exceeds 500€ during the first month:

Lendermarket (+info)

This month it returned €16 and I took the opportunity to add another €200 to my portfolio, which offers a 14.28% return.

In December I invested a small amount of €300 and the experience could not have been more satisfactory. One of my best decisions.

This month they have only published a series of updated investor FAQ (in English).

If you want to benefit from their 1% welcome promotion, click on this banner:

Bondster (+info)

Bondster returned €6 in October, a month in which I took the opportunity to increase my portfolio by €200.

I still want to increase my portfolio to €1,000 before the end of the year and I am well on my way.

This month saw the return of Lime South Africa to funding through Bondster and two new providers: TrustGro (Kenya) and NúNú (Iceland).

With almost 14,000 investors, they are on the verge of reaching €90M funded in record October with over €4.7M.

Get an additional 1% from €100 of investment for the first 90 days:

Nibble (+info)

October has contributed €4 with only €300 initial investment totalling €33 in interest since April.

It is next in my sights to expand my portfolio, as they will soon obtain a supervisory licence from the Estonian FSA (Financial Supervision Authority).

I currently get a 14.5% annual return, but if you don’t want to take risks, take advantage of their classic strategy at 9.7% with Buyback and from 10€:

Esketit (+info)

I am delighted with Esketit, which has returned €8, doubling the best result so far and with only €300 invested in May.

I have already had the opportunity to test their Buyback which works without delays and an autoinvest which works autonomously.

October has been a record October and November could see more than €16M financed and €200K paid in interest to the nearly 900 current investors.

In August I wrote a detailed article about this platform, which you can read here.

It is a new but reliable platform, created by the founders of Creamfinance, with 8 successful years in the market.

If you invest on this great platform, here is an additional 1% bonus for amounts over €100 for the first 30 days:

Estateguru (+info)

As I told you before, I invested €300 at the end of July and I invested another €300 in October.

From the first project I have already obtained €8.25 which you can see here and which in quarterly periods will bring an interest of 11.01%.

I already invested in 2018 with them, but they have improved a lot and their projects are now really interesting.

In fact, they have become the fourth largest platform in terms of EUR funding, with an accumulated €454M and close to 100,000 investors.

If you want to join them, in this banner you have a Welcome Bonus that brings an extra 0.5% to your investment for the first 90 days:

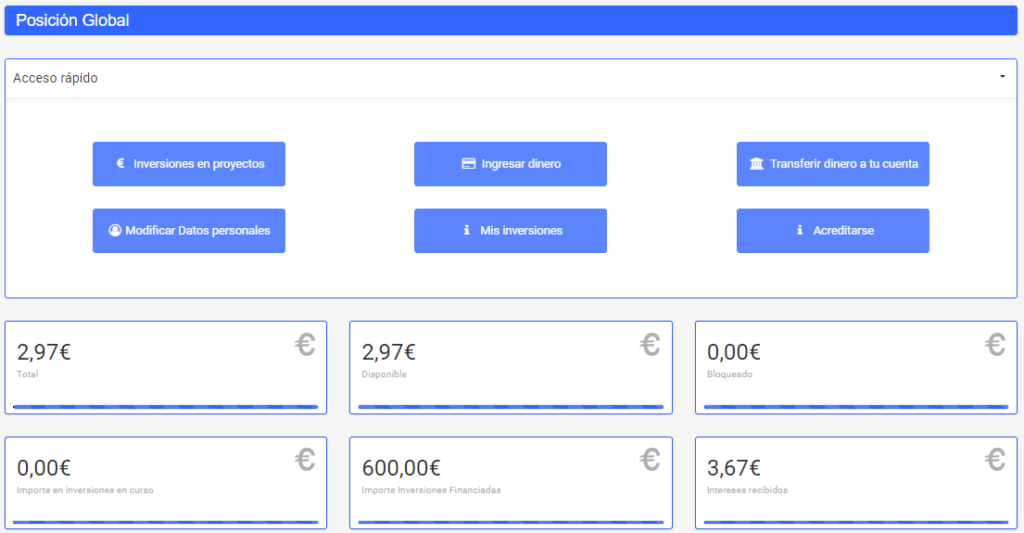

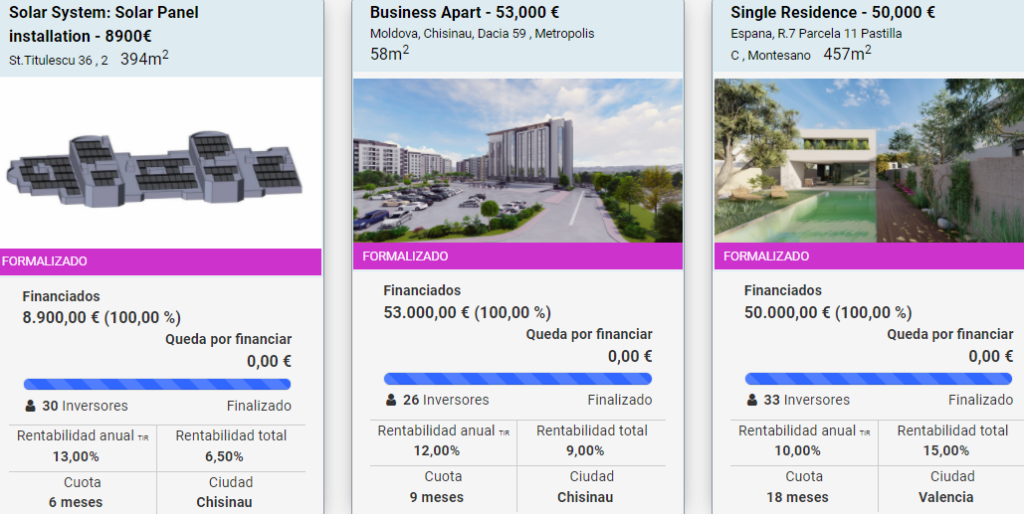

Kirsan Invest (+info)

I have started October with the first €3.67 of interest from the three projects I invested in in September:

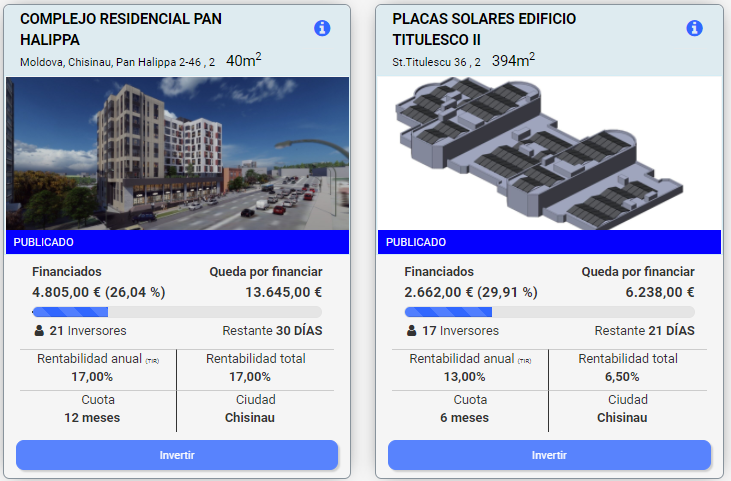

These are the projects in which I have invested €600, at 6 months, 1 year and 18 months respectively, two in Moldova and one in Spain:

They currently have two projects under financing, at 17% and 13% annual return, both in Moldova, a country in full development:

I will give you more details in a month’s time, as they have very interesting projects, a great financial structure with very good backing and very clear ideas.

There is no welcome bonus at the moment.

Platforms with some shadows that I do not recommend investing in

Crowdestor (+info)

In October they have contributed €117 from various interest arrears, but I still have no confidence in this platform.

Four “Elvi Grocery Stores” projects have had €500K in capital repaid, but the number of projects at serious risk of loss continues to grow:

My projects in recovery add up to 25%: Kabuki Restaurant at Salaris, Consumer Loan Portfolio Acquisition and Fertilizer Export Financing.

On a positive note, it appears that Meža Enerģija investors will be paid €20K per week and expect to sell the project by May 2022.

There continues to be a lack of information from Crowdestor, which is the main reason why I do not recommend this platform with an uncertain future.

Iuvo (+info)

Another month in which they have contributed one measly euro to the portfolio, so I am reintegrating my entire portfolio from this platform.

It has been a test that I started in December and has not achieved the expected result.

This is not to say that it is not advisable for many investors, but it is not for me.

As an example, Kviku offers a return of 9.5% in euros in Iuvo, while Bondster offers them at 12%.

And if I want to get more return in foreign currency, they pass on 4.5% for each currency exchange, which is exaggerated in my opinion.

For those who want to give it a try, they have launched IuvoUP, with returns between 3% – 4%. Here you have more information in English and Spanish.

Maybe we will see each other in the future, but a lot would have to change.

Mintos (+info)

This month I have been refunded €25, but there is still €735 in the process of being refunded.

Of this amount, 98% is accounted for by Varks AM, which Mintos has changed from a projected recovery of 70% to 100%, but over a 5-year period instead of 3 years. Welcome.

They have outlined some new developments now that they are licensed as a European investment firm regulated by the Latvian FCMC (Financial and Capital Market Commission).

These include that investors’ monies will be protected up to a maximum of €20K under the investor compensation scheme.

This scheme does not protect against changes in the price of an investment, default of a borrower, lender or issuer.

The platform is changing for the better, but I need to see how it evolves over the coming months to confirm this.

Mintos remains the leading P2P platform in Europe, with almost €7.5 billion funded and almost half a million registered users.

Avoid these platforms

Housers (+info)

Housers has left me (again) with the desire, because I needed a miracle and I thought that maybe this time it would happen. What has NOT happened?

Well, the Albufera project where I invested €50K in 2018 has not repaid the capital nor the last interest signed at the Shareholders’ Meeting, with a payment date in October 2021.

Lawyer Manuel Merino has court hearings against Housers and developer Construbecker on Tuesday 2 and 4 November, respectively. We will see if justice is done and the indications of fraud by both are proven.

In October they paid two months’ arrears on the Torres de Paterna project, but I fear that we will not see any more interest arrears, unless the court case is successful. I hope I am wrong.

I am not in the mood to wait for what happens in that trial, so I will expand on that in the next publication.

Bulkestate (+info)

They have only launched one project in October and after half a month, they have not yet reached 75% of the necessary funding. Something is going wrong.

The reason for this is the distrust of Bulkestate and its refusal to pay monthly interest except for a few projects.

They have a lot of competition and better conditions, such as Estateguru, Reinvest24 or Evoestate.

On the personal front, they have updated the interest receivable on my project, which will be repaid one year late.

As soon as it does, it will be time to abandon this platform, which has two short-term alternatives: renew itself or die.

Crowdestate (+info)

There have been no changes since the announcement of 30 September by Baltic Forest’s insolvency administrator.

It states that the appraisal of the project has been completed and that the first auction will take place in November, so I will publish news shortly.

I am afraid there will be no repayment until the middle of next year, as there are more creditors than just Crowdestate investors.

In June the EFSA (Estonian Financial Authority) granted Crowdestate the certificate of regulated payment institution, but I see that they keep accumulating failed projects.

Furthermore, I wonder why the delay in the presentation of its annual accounts. Do you know that the last ones submitted are from 2019?

In October they have been very active with 10 projects funded, but there has been little progress on the more than 10.5 million outstanding on 31 overdue projects and almost 4 million on 6 unpaid projects.

Lenndy (+info)

We can talk about red flags or express them in many ways, but the conclusion is clear: they have disappeared.

They have not returned the 783€ of outstanding capital for three months, without answering emails or calls.

Could an investor come to your offices in Vilnius and confirm or deny the closure?

And they will still be able to take offence at the fact that a complaint has been lodged against them.