A good month of August has brought more joy than the last few months and some good news, although it is taking a long time for me in terms of work.

While many are enjoying a well-deserved holiday, those of us on the other side are waiting for it to arrive, perhaps in October…

Back to the important stuff, this month has brought in €759 in profits, split between €520 in interest and €239 in bonuses.

It has been exceptional in the case of Robocash over the rest of the platforms, thanks also to the fact that I have invested more than 25.000€.

It has also been a good month at Peerberry with €117 in interest, although they have been publishing few projects lately, which fly among the more than 58,000 investors.

In addition to Robo.cash (+950€) and Peerberry (+1,400€), I have taken the opportunity to increase the portfolios in Esketit (+200€), Lendermarket (+150€) and Viainvest (+150€).

I continue to phase out of Bondster, as I intend to stop working with them as soon as possible.

In September I am expecting the definitive return and withdrawal of Bulkestate, after 18 months of delay, which has been an eternity for me.

I am also hopeful that Crowdestor will return 20% of the Renewable Energy project in September and Consumer Loan Portfolio Acquisition and Kaleju 57 could be sold before November.

And maybe even Housers will give us good news for the sale of Sagasta, even if it is below the estimated price. My first return in four years…

Some of you have asked me how to invest €1,000, €5,000 and even €20,000, to which I always reply that I am not a financial advisor.

But, if after studying all the options you opt for Crowdlending, I would consider 50% to Robocash, 25% to Peerberry, 10% to Viainvest and the remaining 15% among the rest of the recommended platforms: Lendermarket, Esketit, etc.

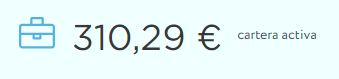

And as a sample of my investments, here is the August return that will pay for my next holiday:

In August I have had a number of friends and family visiting me, which has resulted in some overspending, but there is no better way to spend it than on them.

Despite this, I am still above 51% savings relative to earned income, as you can see here.

This doughnut is more visual to distinguish platforms in full withdrawal (Lenndy, Mintos, Crowdestate, Bulkestate, Housers, Bondster and Crowdestor) and others in clear increase (Esketit, Lendermarket, Viainvest, Robocash and Peerberry):

And in this last graph, you can see the profits for this month of August compared to previous months and years:

Here are the platforms that I am very satisfied with in green, somewhat less so in orange and undesirable in red:

Peerberry (+info)

Another €117 was earned by Peerberry in August, €4 more than the previous month.

Vietnam’s DongPlus originator has joined the portfolio at 12% p.a. and is guaranteed by the Aventus Group.

With regard to projects affected by the conflict in Ukraine, 42.21% have already been repaid. Here you have more information

In big news, Peerberry was the number one funded platform in July, €3.5 million ahead of Mintos, which lost its preferred position.

This month I have added €1,400 to my portfolio, thus starting the challenge of reaching Gold status (+€25K invested) and its additional return of 0.75%.

Peerberry has surpassed €1.3 billion in funding and has already paid over €15 million in interest to the nearly 59K current investors.

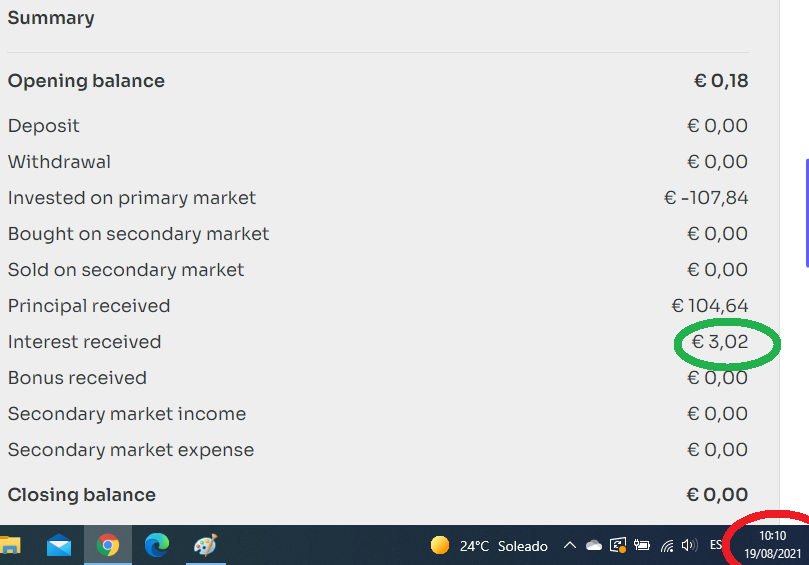

This is the main panel, which contains the status summary of this great platform:

If you want to invest in them, here they add 0.5% of your investment if it exceeds €500 during the first 30 days:

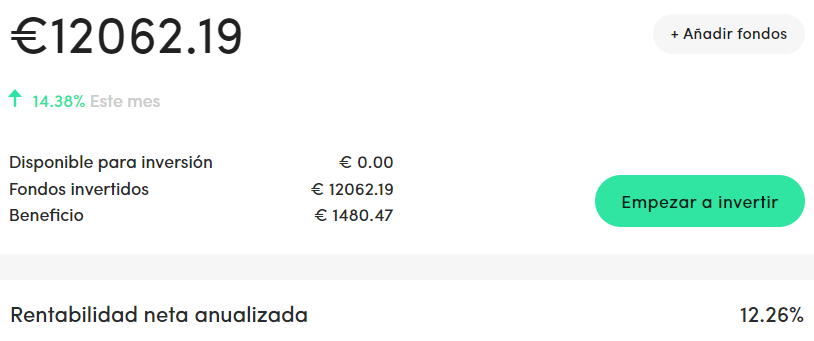

Viainvest (+info)

They have contributed €19 in August and it is one of the chosen ones in which I have increased the portfolio by €150.

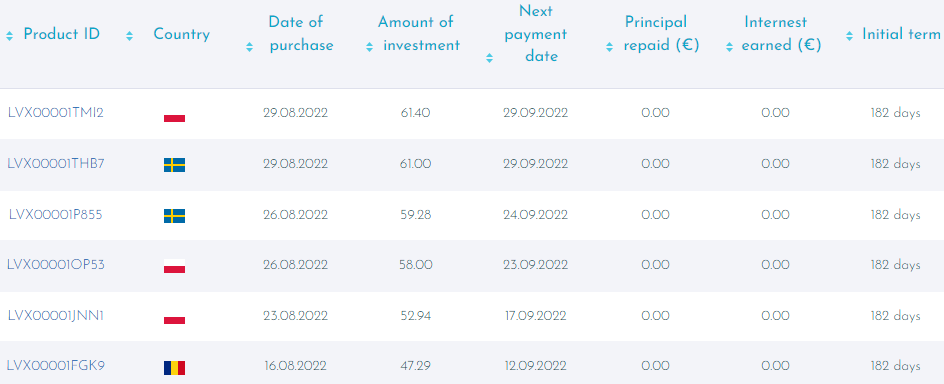

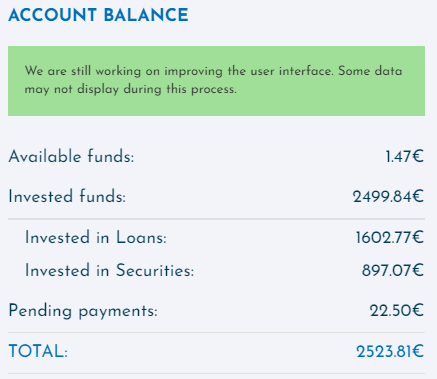

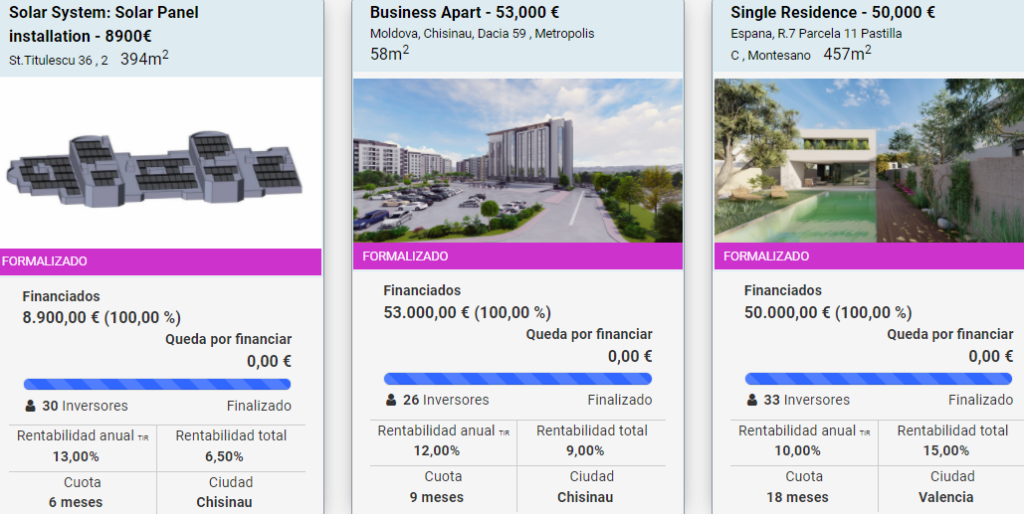

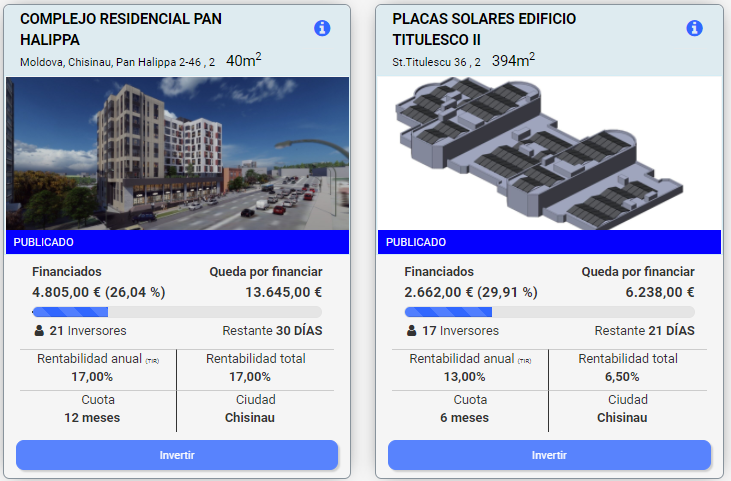

On 2 August they completed the transition from individual loans to asset-backed securities which have not been well communicated.

The biggest complaint has been about the duration of the securities (182 days), which had not been reported previously.

This has caused them to send an email to every investor explaining the maturity process of asset-backed securities, hoping that everyone would understand it, which has not been achieved.

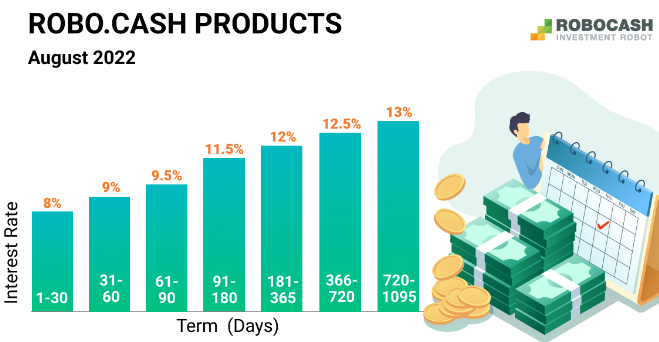

In any case and after studying them in detail, I trust this new safer product, although I prefer to invest manually for a while to check each one before investing.

Therefore, I do not make use of autoinvest and when an individual loan ends, I reinvest it in a security of my choice that I study in detail.

Here you can see some of the latest ones:

And in this chart you can see that I still have almost twice as many individual Loans as the new Securities, although they will be rebalanced as they are finalised:

I am interested to see whether investment financing falls or, on the contrary, continues to rise steadily.

If you want to start earning, this banner gives you €15 just by investing more than €50. What are you waiting for? With only 50€!

Robocash (+info)

Robocash has come out in August and has brought in €293 in interest and another €200 in welcome bonus… Olé, olé y olé.

The increase is remarkable because I have surpassed €25K invested which brings a +1% return.

August has brought 640 new investors, we have raised €610K in returns and €17 million has been funded.

But I must say that, although the figures are exceptional, I have a complaint towards one originator: Unapay.

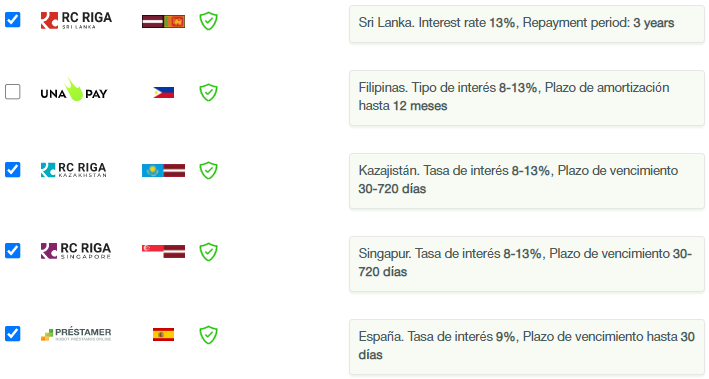

I have therefore modified my autoinvest to not invest with them as they are the only ones in arrears, even if they apply their 30-day payback:

On the other hand, on 24 August they lowered the profitability percentages, which are as follows:

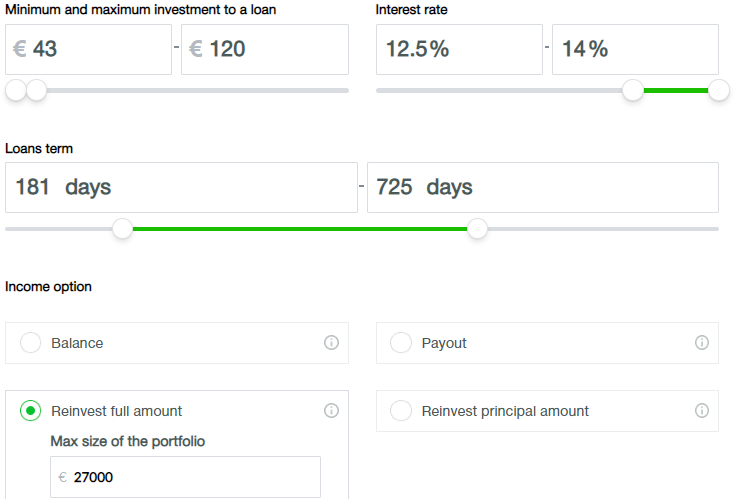

I recommend investing in longer-term projects with higher returns, as they also pay interest once a month.

As a sample, here is my automatic investment chart:

Another new development in August is that Natalya Ischenko has been promoted as the new CEO of Robocash, while Sergey Sedov continues as Chairman of the Board.

Don’t miss the opportunity to join them in this banner, where they add 1% of your investment if it exceeds 500€ during the first month:

Lendermarket (+info)

This platform is giving me a lot of joy and I have rewarded it with an additional €150 added to my portfolio.

I intend to exceed €5,000 in December, even more so if the completion of the Crowdestor projects and the sale of Housers materialise.

Below is my panel where the yield has risen further to 14.32% and arrears have fallen to over 31 days:

If you want to benefit from their 1% promotion for investments over 300€, click on the following banner:

Esketit (+info)

This month they have contributed €8 in interest and it is still the platform with the highest annual return: 14.85%.

With my €200 contribution to the portfolio, I have over €1,000 invested and hope to double it before December if it continues to perform so well.

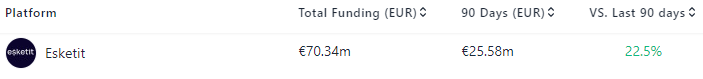

If we compare the last 6 months, we can see that they have financed more than €46 million and during the last 3 months it has doubled:

Over €81M invested, 3800 investors and more than €1.3 million in interest.

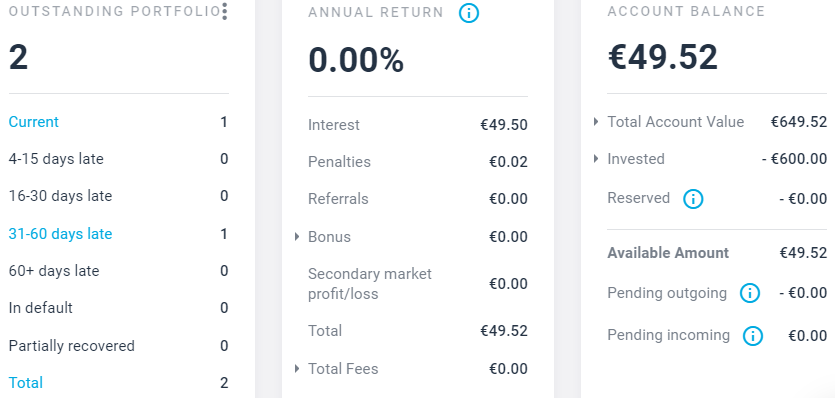

Below is my dashboard, where you can see that only €42.36 is more than 31 days overdue out of the €1,050 invested:

And the main thing is that they continue to keep their failed projects at ZERO since they started in January 2021.

In August, they launched the “Esketit Experience”, which is a series of interviews. The first interview aired, you can watch it here.

If you invest on this great platform, here is an additional 1% bonus for amounts over €100 for the first 30 days:

Estateguru (+info)

In August they paid a backlog of €8.25 for July, but I am still waiting for another one, which they say they are looking for a solution to.

I hope that in September it will be regularised, as we have been waiting 36 days for them to comply with a payment to which they committed themselves on 16 August.

At the moment, this platform is leaving me with some doubts, so I will wait until the end of September before making a decision.

I already invested in 2018 with them, but I see that delays are still common, or maybe it was my choice of projects?

The fact is that there are 140,000 investors and their feedback is really good, so I will give them another month’s leeway.

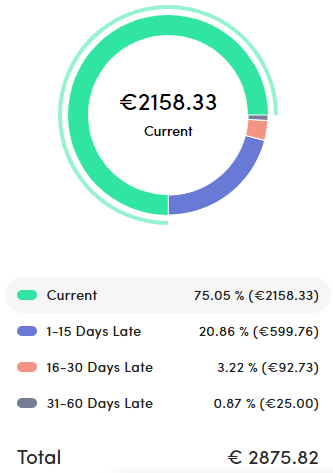

Here is my dashboard, showing the project backlog and the interest generated since July 2021:

If you want to join them, in this banner you have a Welcome Bonus that brings an extra 0.5% to your investment for the first 90 days:

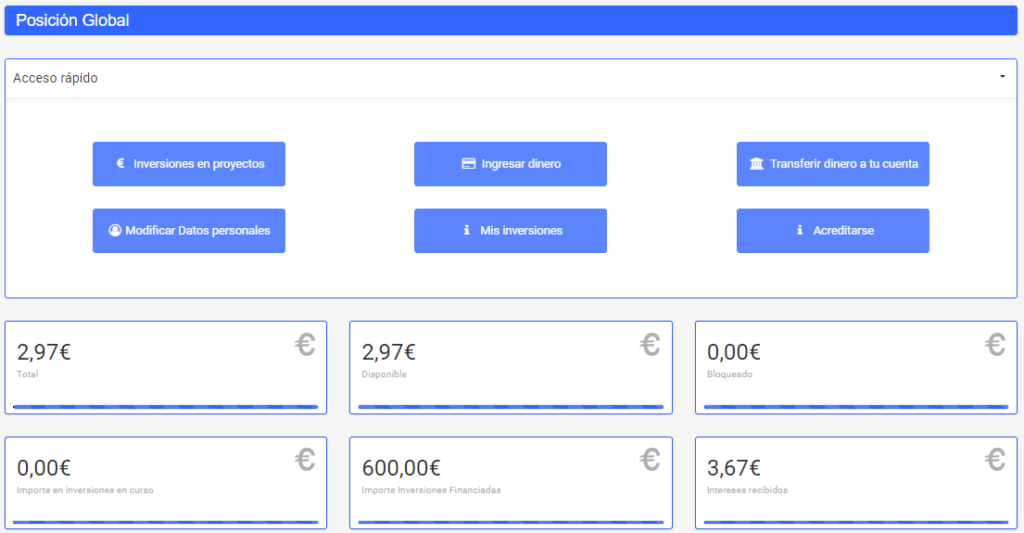

Kirsan Invest (+info)

August has brought me €4 again and now it’s time to let compound interest do its job and continue accumulating capital to invest.

As of 31 August, they have just funded their latest project and have told me that they are going to launch several in a few days.

I have also been given an update on the change in the image and usability of their website, which will take place in October.

This is my panel as of today, with 220€ waiting for them to launch their next project:

They continue to close projects with some dynamism and have already financed 27 projects with an average return of 11.87%.

They have a welcome bonus of €10 from a minimum investment of €200, which you can take advantage of here.

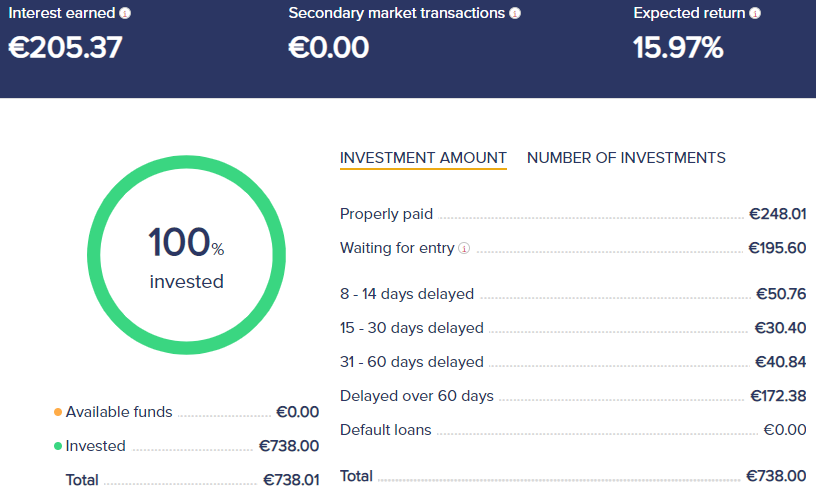

Bondster (+info)

August has brought €11 in profitability, which has also dropped due to the fact that I have withdrawn €139 this month.

They have paid back some of their arrears over 60 days, which in July were over €207 and have now been reduced to €172.

In July I already withdrew the welcome bonus as I have stopped recommending investment on this platform until further notice.

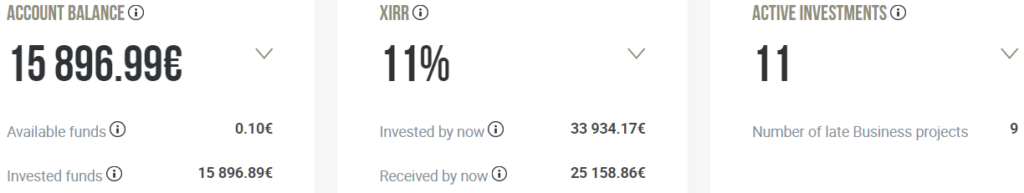

Crowdestor (+info)

This month they have contributed a meagre €32, a figure they have not suffered since August 2021.

But I remain hopeful that they will return 20% of the Renewable Energy project in September, plus a possible sale around November of the Consumer Loan Portfolio Acquisition and Kaleju 57.

Month after month, the profitability is decreasing and is down 0.15% compared to last month, as my panel shows:

I have been in full retirement for two years now, in which I have reduced just over €11,000. I hope to get rid of the remaining amount in another two years…

Just in case, I remind you that I do not recommend investing in any way in this platform, which I keep in the shadows because it continues to return projects, albeit at a very slow pace.

Housers (+info)

What happened in Housers in August? Something VERY important: they have proposed a vote for the sale of the Sagasta project, even if it is below the estimated price.

I am particularly excited, because it will be my first return in four years… Now all that remains is for the tenant to leave (to see how he has left the house), for the sale to be closed, for the money to arrive and for the company to be liquidated. Optimistically, around November.

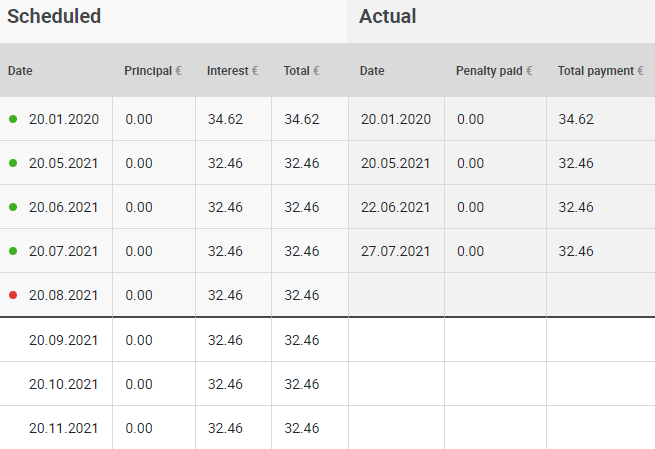

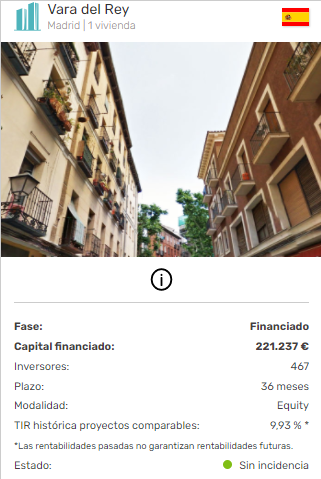

And then I show you the Sagasta project which, with an estimated duration of 24 months and being funded on 27/01/2017, is still showing “No incidence”.

Perhaps 44 months behind schedule is not enough for “Overdue” to appear instead.

And that is all in relation to this platform that has been giving us, the long-suffering investors, so much trouble for the last four years.

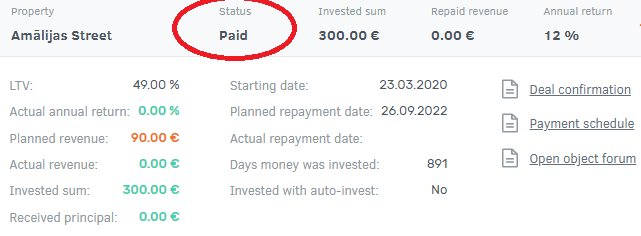

Bulkestate (+info)

I am still waiting for the Amalijas Street project to be returned in September, 18 months behind schedule.

What I do not know is why it appears “Paid” in the project, when it has not been paid and the proposed date is 26/09/2022:

As soon as they pay it, I will say goodbye to them for good, although I have to say in their defence that at least they have kept us informed.

Maybe it will pick up in the future, but I doubt they will be able to count on me by then.

Crowdestate (+info)

Still no news, apart from the third unsuccessful auction to sell off the Baltic Forest projects, which are more than two years behind schedule.

Crowdestate has filed a legal claim against the project managers.

The additional problem is that they have not provided any information about this project for four months. Does it cost them that much?

Yet another platform that has lost investor confidence due to the accumulation of failed and delayed projects.

On the other hand, the last monthly report dates from October 2021 and the latest annual accounts date from 2019. Weird, isn’t it?

Remaining reported and doubtful platforms

We remain confident that justice will take its course and we will recover the failed investments between 2019 and 2020.

Since then, no platform has failed. The new European regulation has a lot to do with this.

We have new developments in the investigations against Kuetzal and they are VERY optimistic, as their conglomerate has been unravelled.

We expect to have a proposal for payments shortly from two originators.

Progress on Envestio has been made in Malta and Estonia, but there is still a long way to go.

And from Monethera I am still waiting to testify against them, so I remain at the disposal of the competent authorities when they require me.

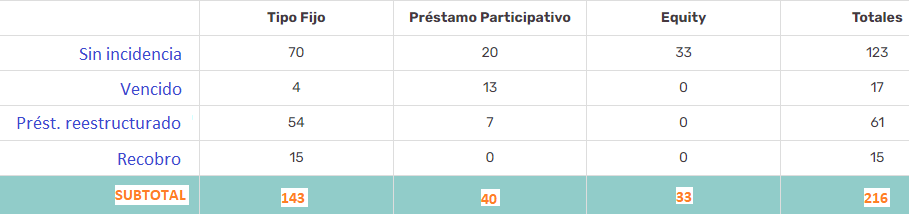

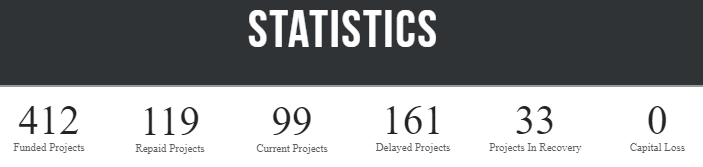

412 funded; 119 repaid; 99 current; 161 overdue; 33 in recovery; Capital lost: 0€

412 funded; 119 repaid; 99 current; 161 overdue; 33 in recovery; Capital lost: 0€