There are no better words to describe it: it has been a great summer and the month of September deserves no other description: exceptional.

This adjective is justified after earning €1,100 in September and a total of €3,453 in the last four months:

Aren’t these reasons to be satisfied? The main reasons are that Peerberry and Robocash have exceeded expectations and that Housers has repaid the Albufera project and also the Torres de Paterna project after a delay of three months.

In August I received €3,300 which have been reinvested in various portfolios and Crowdfunding continues to give me a lot of joy.

In July I invested €300 in Estateguru to diversify my real estate portfolio and I expect the first returns in October.

I have also invested €600 in Kirsan Invest, a very successful real estate company in Moldova that has recently arrived in Spain and will yield just over €5/month.

I will add more information on both platforms in October. For the time being, they are reflected in the portfolio:

And now, on to the month’s news, with big news from some of the platforms:

The BEST and recommended platforms with welcome BONUS

Peerberry (+info)

This month I broke the monthly return record with €128, which you can see in detail in Crowdlending > European Crowdlending > Peerberry:

There are many new developments at Peerberry. On the verge of obtaining a crowdfunding licence in Lithuania, Peerberry is moving its operations to Croatia as of 1 October.

Nothing has changed in terms of investors, but Peerberry’s corporate structure has changed and its share capital has increased to €125K.

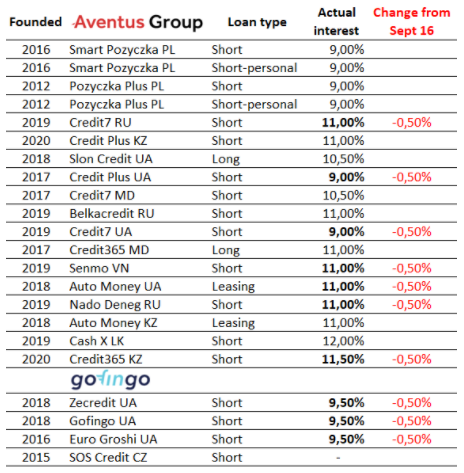

The “bad” news is that due to the success of the platform, the profitability of some originators is being adjusted downwards:

They are continuing with their plans to launch a secondary market and also to obtain the EMI (Electronic Money Institution) licence to become a payment provider.

It remains the second largest platform by volume financed, with more than €53 million, behind Mintos with €160 million.

It is so clear to me that they are in my TOP5, that in September I added another 900€ in Peerberry.

Here they add 0.5% of your investment if it exceeds 500 euros during the first 30 days:

Viainvest (+info)

Viainvest’s contribution of €11 is welcome in September, a month that brings many new features.

They have just obtained their IBF Licence and will be supervised by the Latvian Financial Commission (FCMC), which provides security for investors.

The best thing is that 90% of the ultimate loss is covered for a maximum of €20K, among other terms.

Now more than ever, I will expand my portfolio with them given the additional security this news brings.

On the other hand, I already announced last month that they have set an 11% interest rate on all their projects. We had to give up something.

In this banner you get €15 just for investing more than €50. What are you waiting for? With only 50€!

Robocash (+info)

I was already happy with last month’s €70 and then September comes along and gives me €95!

Every day I am happier to invest in Robocash, this month I have added €1,800 which brings me closer to the Silver category (+€10K) which brings an additional +0.5% return.

They have published their FBK Grant Thornton audited results for the first half of the year, which you can see in detail here in Spanish and here in English.

In summary, they have exceeded last year’s funded loans by 134%, making a net profit of €13.3m.

They also reached two milestones: €300M in funded loans and over 19K active investors.

In this banner they add 1% of your investment if it exceeds 500€ during the first month:

Lendermarket (+info)

This month it has returned €5 with only €420 invested and maintains its return above 14%.

Grant Thornton has also audited its accounts from June 2019 to December 2020 with a notable increase between the two years.

Credistar Group, parent company of Lendermarket, has been licensed as a credit provider under the supervision of the FSA in Denmark.

If you want to benefit from their 1% welcome promotion, click on this banner:

Bondster (+info)

Bondster has yielded only €3 in September, but 16 projects end shortly and I expect to reach €5 again in October.

I still want to increase my portfolio to €1,000 before the end of the year.

Acema has started to publish real estate projects with yields between 10-11%. I think this is a low return for second-lien mortgages.

Acema also allows you to invest in projects secured with Bitcoins. Here you have the news.

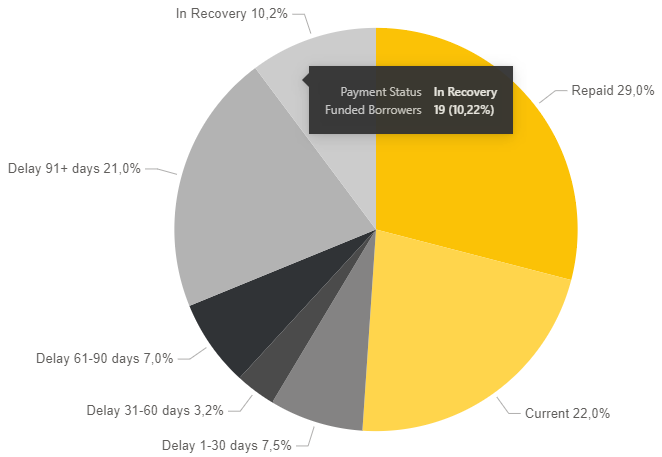

The average arrears rate is less than 0.1% in Bondster, but Acema is the originator with the highest arrears:

In my opinion, it is better to invest from 15%, less than 5 months and with Buyback in Rapicredit, LimeZaim, Quickcheck and LimeSouthAfrica.

They have reached 13,400 investors and more than €3.2 million in interest.

Get an additional 1% from €100 of investment for the first 90 days:

Nibble (+info)

This month they have contributed €5 with only €300 of initial investment for a total of €29 in interest since April.

It is the only one, together with Esketit and Lendermarket, that exceeds 14% profitability and it seems that they will soon publish some new products.

Nibble has applied for a supervisory licence from the Estonian Financial Supervision Authority (FSA).

It is also in the process of obtaining AML (Anti-Money Laundering) certification for the prevention of money laundering.

Take advantage of their classic strategy, which offers 9.7% with Buyback, with NO risk and a minimum investment of €10:

Esketit (+info)

Delighted with Esketit, he has contributed €4 in September and has already contributed €26 since May, which is not bad at all.

I have already had the opportunity to test their Buyback which works without delays and an autoinvest which works autonomously.

In August I wrote a detailed article about this platform, which you can read here.

It is a new but reliable platform, created by the founders of Creamfinance, with 8 successful years in the market.

If you invest on this great platform, here is an additional 1% bonus for amounts over €100 for the first 30 days:

Platforms with some shadows that I do not recommend investing in

Crowdestor (+info)

Despite the fact that Crowdestor has contributed €122 this month, which is not an insignificant amount, I still have no confidence in this platform.

Only two of the twelve projects are up to date, but their repayment date of March-April 2021 is still a long way off.

The M119 project should have been returned this month, but it is five months behind schedule and the others are four to thirteen months in arrears.

Special mention should be made of the recovery projects: Kabuki Restaurant at Salaris, Consumer Loan Portfolio Acquisition and Fertilizer Export Financing.

Of the first two, we have not received any information for six (6) months and of the last one we know that it is in the hands of the Courts.

This lack of information is UNACCEPTABLE on the part of the person in charge of Crowdestor, to whom I ask a question:

Jannis Timma (I add your LinkedIn link here), we are 25,000 investors with more than €36M unpaid. How much does it cost for an administrative assistant to bring the backlog of 151 projects up to date?

Here you can see the status of the projects as of today. In summary, 19 million repaid and 36.3 million in arrears:

You can understand that I do not recommend investing in this platform and that its future is very much in doubt.

Iuvo (+info)

This month it has returned €2 and I have decided to reintegrate my entire portfolio from this platform, slowly but surely.

It has been a test that I started in December and has not achieved the expected result.

This is not to say that it is not advisable for many investors, but it is not for me.

Kviku offers returns of over 19% in roubles, but they pass on 4.5% at each currency exchange, so 10% and no Buyback loses all interest.

In addition, they have not provided audited accounts for 2020 and have 3 million euros in the process of recovery.

Mintos (+info)

It is already licensed as a European investment firm regulated by the Latvian FCMC (Financial and Capital Market Commission).

Like Viainvest, investments are covered for a maximum of €20,000, which is why I have promoted Mintos to platforms with doubts.

I have to see how it evolves over the next few months to see if it gives me confidence again, because I still have €760 to recover.

This month I have reduced this amount by €13 and there are many months left to recover an estimated 70%. I’ll write off about €300.

Mintos remains the leading P2P platform in Europe, with €7 billion funded and 430,000 registered users.

Avoid these platforms

Housers (+info)

It is hard to believe that Housers has fulfilled some of its commitments: Albufera and Torres de Paterna, both from the denounced developer Construbecker.

It has, however, failed to meet its commitments on six other projects, which is the norm.

There is so much information this month that it is going to be too long, but here is the summary:

- Convening of meetings on the change of model for the exclusive benefit of the administrator. For instance, Iriarte. The administrator convenes a meeting to change from the “investment” model to the “savings” model. This way he can rent the flat and collect his €350 a month, while he does not make any profit on the sale. Incidentally, Iriarte has already been rented and we investors have not seen a euro. Can anyone imagine where the money is?

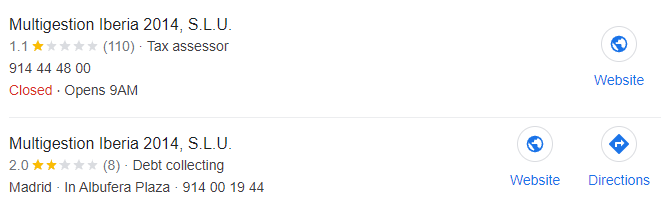

- Notice of meetings on the takeover of a debt collection company (Multigestión Iberia). Some of those affected trusted them and, after a year, have still not received a single euro. Google them and you will see the comments:

NOTE: When the necessary quorum is not reached (thank goodness), Housers launches another meeting to award the recovery project to Multigestión Iberia despite the punctual fulfilment of the schedule without a single delay. And when I ask Housers they reply that it is “just in case they stop paying”.

- Calling meetings to vote on a new timetable when the current one is in force and payments are being made by the developer. Example: Albufera.

In other business, the first extraordinary meeting called by the investors in the Mesón de Paredes project was held on 30 September. They have won by a majority and got rid of the administrator Atrium Lex, which translates into a saving of €2,520 per year. The project will now be managed by a Board of Administration made up of stakeholders who will manage the asset at no cost and intend to sell or lease it at market price.

On the other hand, the Tax Agency has revoked Atrium Lex’s Tax Identification Number for measures to prevent tax fraud.

Courtesy of the Association of People Affected by Housers, here is a list of dozens of failed projects:

Bulkestate (+info)

In September they have launched 6 new projects and still no news of interest.

My project will be returned a year late (I hope), at which point I will leave this platform because they have lost my trust. And the information they provide is not correct either:

At least some pictures of the project have been published, although it is far behind schedule and far from completion in March 2022.

Lenndy (+info)

I am very disappointed with Lenndy. They have not refunded the 783€ of outstanding capital for two months.

And they will still be able to take offence at the fact that a complaint has been lodged against them.

They have missed their payment schedule, but I must be patient, as there are two and a half years left until I am rid of them.

Crowdestate (+info)

On 30 September we received a new communication from Baltic Forest’s insolvency administrator.

It states that the appraisal of the project has been completed and that the first auction will take place in October or November.

It expects to sell the property this year, but due to certain disputes, the return to investors will not be made until they are resolved.

Hopefully as soon as possible, because in addition to the €2,600 of capital invested, there is €380 in accrued interest pending payment.

In June the EFSA (Estonian Finance Authority) granted them the certificate of regulated payment institution, but they continue to accumulate failed projects.

In September they have been very active, launching 11 projects and successfully returning 17.

But let’s not forget that they have more than 4 million outstanding on 20 overdue projects and more than 3 million on 5 unpaid projects.