In fact, I obtained €804, which is not enough, because I was expecting a much better month of July. All the more so because I had high hopes for various Housers and Crowdestor projects.

Housers has failed in 7 of the 9 projects invested, while Crowdestor has met half of the expected payouts.

Nevertheless, the €804 of the total €141,934 invested are welcome:

And this is the graph of the profitability obtained since I started the blog in May 2019:

And now, let’s get to the month’s news, with big news from some of the platforms:

The BEST and recommended platforms with welcome BONUS

Peerberry (+info)

This month I have increased my portfolio by €300 and they are still a safe bet. They have contributed €36 with less than €3,000 invested. Does any bank offer this?

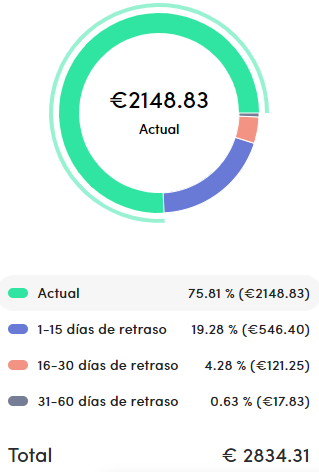

But the most important thing is the security it offers. And here is the proof, with less than 5% more than 16 days overdue:

This month has been exceptional for Peerberry: its partner Credit Plus KZ earned more than €300K net after auditing 2020, Peerberry netted €142K, Senmo VN continues to perform well, SIB Group paid out €16,000 in interest after completion of the K32 real estate project, and they have achieved a €142K net profit. new record with €43M funded.

My goal at Peerberry is to reach Silver status (€10K) which offers an additional +0.5% and which I hope to achieve before December 😉

Here they add 0.5% of your investment if it exceeds 500 euros during the first 30 days:

Viainvest (+info)

Another €9 from Viainvest in July, and the additional €350 I added in June is already being felt.

Viainvest has exceeded 24,000 investors and €250M financed

For the time being, I continue to diversify on this platform by loan type, country of origin and amount. Here is a sample:

My medium-term goal for Viainvest is to increase my portfolio to around €3,000 with regular quarterly contributions.

In this banner you get €15 just for investing more than €50. What are you waiting for? With only 50€!

Robocash (+info)

How good it feels to win €69 on Robocash! This month has brought a few new developments, among which the TOP 10 among European platforms has been approaching.

It is one of the only ones that also operates in non-EU countries such as Singapore, the Philippines and Vietnam, among others.

In July I have increased my portfolio by €300 and my confidence in them is absolute.

Having invested over €5,000 I reached the Bronze category (+0.3% additional) and now, as in Peerberry, I am going for €10K (Silver category, which contributes +0.5%).

And I have some great news: the interview I conducted with Dmitry Balakhnin, Director of Communications at Robocash, will be published in August. I’m sure you’ll like it!

In this banner they add 1% of your investment if it exceeds 500€ during the first month:

Lendermarket (+info)

This month it has returned €5 with only €411 invested and maintains its return above 14%.

In July, they have exceeded €130 million in funding and 3,000 active investors.

And given its excellent figures, chairman and founder Aaro Sosaar has brought on board Endrik Eller as CEO and Omayra Roig as Head of Operations.

If you want to benefit from their 1% welcome promotion, click on this banner:

Bondster has responded in July with €3, which is not enough for me, but it is true that a third of my portfolio is in arrears which will be paid in August because they pay them back promptly after 60 days of delay.

Pavel Klema replaced Jana Mückova as CEO in March and has done a great job since then.

The most significant of these has been the launch of the secondary market on 1 July, which makes investment even more attractive.

But he has also surrounded himself with a great team, the latest being the recruitment of a new marketing and sales manager: Richard Kouba.

If the economy allows me to do so, I will close this year with a portfolio of close to €1,000.

Get an additional 1% from €100 of investment for the first 90 days:

Nibble (+info)

I am still delighted with this easy-to-use platform which brought me €4 in July and about which I wrote a detailed article three weeks ago.

In total, it has generated €12.82 since mid-April, making it the platform with the highest return: 14.5% per annum.

Nibble offers micro-credits issued by Joymoney Spain and Joymoney Russia. Moreover, the latter will be 7 years old in August.

Nibble is currently in the process of obtaining the AML (Anti-Money Laundering) certificate.

They have also applied for a supervisory licence from the FSA (Financial Supervision Authority) of Estonia.

Remember that on August 31 ends the promotion in which they offer 11.7% instead of 9.7% in their classic investment strategy, with Buyback, with NO risk and with a minimum investment of 10€.

Esketit (+info)

It has contributed €3.63 in July and is already giving me my first joys. Its Buyback works without delays, it is easy to use and its autoinvest works autonomously so you don’t have to worry about it.

I will write a detailed article in August because it is still an unknown platform that deserves its place in the market.

Even more so if it comes from the founders of Creamfinance, created in 2012 with enormous success.

Here you get an additional 1% bonus on every investment over €100 you make during the first 30 days:

Platforms with some shadows, not recommended for investment

Crowdestor (+info)

This month Crowdestor is in this section as it has contributed €171 and I expect several returns at the beginning of August, but it has been, together with Housers, the “big disappointment”.

In July they launched their big bet called Crowdestor Flex, consisting of a 12% return payable daily and with a maximum contribution of €2,000 per month.

Please note that transferring the amount from the Flex account to the traditional Crowdestor account costs €1.

They have also gone for Auto Invest, although they have hardly advertised it. I do not recommend using this tool on this platform.

Crowdestor is experiencing some difficulties in financing its new projects and, as we all know, in dealing with its growing backlog of projects.

Here you can see that the number of projects with problems is almost double the number of those that are up to date with payments.

For the time being and until they reduce their high risk of default, I do not recommend investing in this platform and I withdraw the welcome bonus.

Iuvo (+info)

Although it has returned €4 this month, I still have some doubts about this platform.

I started investing in roubles in their originator Kviku two months ago and have already seen an increase in profitability, but at extra risk, because no project has Buyback.

I must also say that Kviku has significant financial muscle, with the group having been on the market since 2013 without incident.

Euro investments are safer, although their return is low according to my expectations.

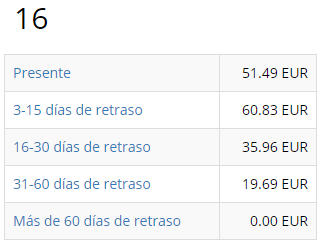

But you know the best thing of all? It turns out that the 10 investments in roubles at 19.74% average yield are current, while 2/3 of the 16 investments with Buyback in euro are in arrears:

On the other hand, they apply an undesirable exchange rate (approx. 4% above the market).

In short, I will wait at least another month to see how it evolves. It is still a platform that I have been testing since December.

In any case, I do not recommend investing in it today.

Run away from these platforms. Don’t even think of investing

Housers (+info)

This month Housers has fulfilled 50%: on the one hand it has paid the second commitment of the Albufera III project, but has not paid the first commitment of Torres de Paterna, in addition to 6 other unfulfilled projects.

And this is the second opportunity offered to the developer Construbecker to fulfil its non-payments, so we will have to wait for the success of the complaints made against it.

On the other hand, active proceedings remain open against Housers, its managers and several property developers for fraud.

The CNMV (National Securities Market Commission) was informed on 13 July of these criminal investigations against them and may act accordingly.

In addition, on 19 July, the collective complaint for the crime of fraud was filed with more than 700 documents provided, which was delayed due to its difficulty before The National High Court and which affects the operations known as “savings” and “investment”. The judge should rule on its admission for processing.

On another front, several investors affected by the Vara del Rey project have joined forces to take back the management of the company. A letter has already been sent to the administrator to convene an extraordinary meeting.

On the other hand, they claim to have reached 130,000 registered users in July (some are still unaware of this) and have returned three projects, but there are only 212 to go!

Mintos (+info)

I have been refunded €40 this month and there is now €806 still to be recovered, mostly from Finko AM.

The good news is that Mintos has recovered 100% of Aforti this month, which was unexpected.

Among other news, Iute Credit has issued an unaudited first half-year report, DelfinGroup has launched new bonds worth €5 million and Mintos has downgraded the status of E-cash and Dziesiatka.

But the most anticipated is that Mintos has announced that it will become an investment platform authorised by the FCMC (Financial Capital Market Commission of Latvia) by the end of August.

Finally, Mintos has added Fenchurch Legal to its portfolio.

I continue to withdraw my portfolio, as the investment in one of the TOP originators at the time left more than €1,000 in the process of recovery, of which I will recover a maximum of 70%.

Bulkestate (+info)

It has launched two single projects this month, one of which for a total of €1.6 million that have been funded by fewer than 18 investors. That’s almost €100K per person!

It seems crazy to me, even more so with the delays this platform is suffering, but I am not one to tell anyone where to invest their money.

My project will be returned a year late and, since they have no secondary market, I can only wait.

Lenndy (+info)

This month I have been refunded almost €15 of the total €800 of capital still outstanding, which will not be repaid before March 2024.

In May I put my two assets up for sale at a 21% discount, but no one has yet been interested.

Crowdestate (+info)

It has reported that Baltic Forest’s insolvency administrator has liquidated €34K worth of various tools and equipment.

The real estate assets have yet to be assessed to offset the six civil claims against them, with Crowdestate investors being the most harmed.

The EFSA (Estonian Financial Authority) has granted them the certificate of regulated payment institution and, as a consequence, there have been several changes in their management structure.

In addition, they have financed the first Portuguese project in the Algarve, have had 8 projects repaid, 22 are in arrears (€10.9 million) and €3 million remain unpaid.